<h1>Understanding the Bitcoin Dominance Index: A 2025 Perspective</h1>

<p>According to Chainalysis 2025 data, a staggering 73% of cryptocurrency traders are confused about Bitcoin‘s influence on the market. This confusion stems from the Bitcoin dominance index, an essential tool for evaluating Bitcoin‘s share of the total cryptocurrency market. In this article, we‘ll dissect what the Bitcoin dominance index means for traders and its implications in the evolving landscape of digital assets.</p>

<h2>What is the Bitcoin Dominance Index?</h2>

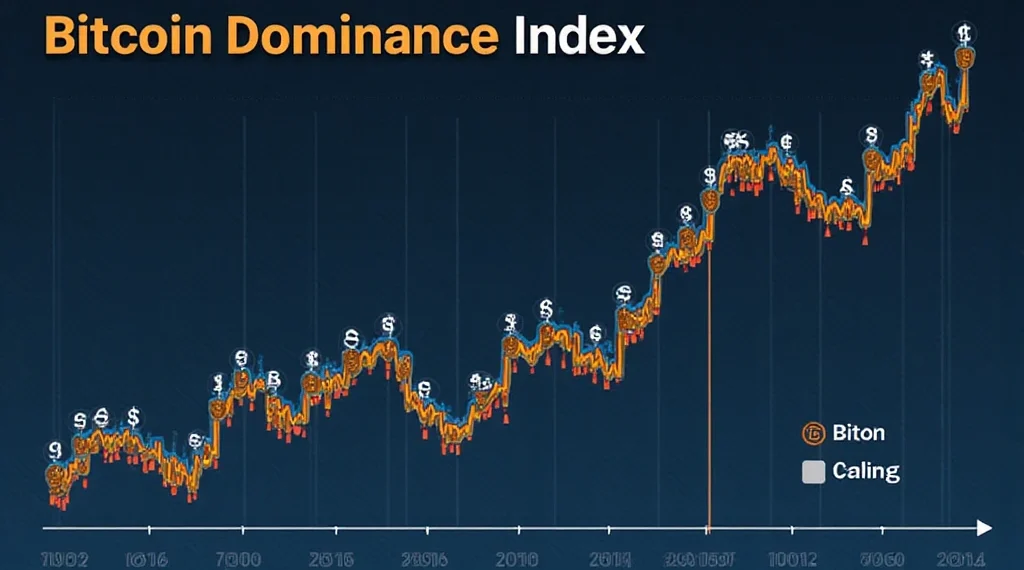

<p>The Bitcoin dominance index (BDI) measures Bitcoin‘s market capitalization as a percentage of the total cryptocurrency market. To put it simply, think of it like a pie chart where Bitcoin represents a slice of the entire cryptocurrency pie. When its slice gets bigger, it indicates that Bitcoin is becoming more popular compared to other cryptocurrencies.</p>

<h2>Why Does the Bitcoin Dominance Index Matter?</h2>

<p>The BDI is crucial for traders as it signals bullish or bearish trends in the crypto market. For instance, if Bitcoin‘s dominance rises, it often means traders are more confident in Bitcoin compared to altcoins. You might relate this to a local market scenario where shoppers flock to one stall over others, indicating trust in its offerings. Monitoring the BDI can help you‘d anticipate market movements and strategize accordingly.</p>

<h2>Implications of DeFi Regulation on the Bitcoin Dominance Index</h2>

<p>With the rise of decentralized finance (DeFi) platforms, Bitcoin‘s market influence may change significantly. New regulations coming in 2025, especially in markets like Singapore, could also lead to fluctuations in Bitcoin‘s dominance. It’s similar to a new store opening in your neighborhood – it could either draw more customers to the area or shift focus away from existing stores, impacting everyone involved.</p>

<h2>What Factors Influence the Bitcoin Dominance Index?</h2>

<p>Several factors can affect the BDI including market sentiment, the emergence of new technology like cross–chain interoperability, and the adoption of proof–of–stake (PoS) mechanisms. Imagine a neighborhood block party where everyone is invited; if one resident starts providing free food, parties would shift focus to their place, all contributing to a change in dynamics. Similarly, shifts in technology can tilt the Bitcoin dominance index.</p>

<p>In conclusion, understanding the Bitcoin dominance index is vital for navigating the evolving cryptocurrency landscape. If you want to gain deeper insights, download our comprehensive toolkit to enhance your trading strategies!</p>

<p style=“font–weight:bold;“>Download the toolkit here!</p>

<p style=“font–style:italic;“>Disclaimer: This article does not constitute investment advice. Consult your local regulatory authority, such as the MAS or SEC, before making any trading decisions. Tools like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.</p>

<p>Explore more about cross–chain mechanisms and DeFi guidelines at <a href=“https://hibt.com“>hibt.com</a>. Check out our <a href=“https://hibt.com/cross–chain–whitepaper“>Cross–chain security white paper</a> for detailed insights.</p>

<p style=“text–align:right;“><em>OKHTX</em></p>

<p>According to Chainalysis 2025 data, a staggering 73% of cryptocurrency traders are confused about Bitcoin‘s influence on the market. This confusion stems from the Bitcoin dominance index, an essential tool for evaluating Bitcoin‘s share of the total cryptocurrency market. In this article, we‘ll dissect what the Bitcoin dominance index means for traders and its implications in the evolving landscape of digital assets.</p>

<h2>What is the Bitcoin Dominance Index?</h2>

<p>The Bitcoin dominance index (BDI) measures Bitcoin‘s market capitalization as a percentage of the total cryptocurrency market. To put it simply, think of it like a pie chart where Bitcoin represents a slice of the entire cryptocurrency pie. When its slice gets bigger, it indicates that Bitcoin is becoming more popular compared to other cryptocurrencies.</p>

<h2>Why Does the Bitcoin Dominance Index Matter?</h2>

<p>The BDI is crucial for traders as it signals bullish or bearish trends in the crypto market. For instance, if Bitcoin‘s dominance rises, it often means traders are more confident in Bitcoin compared to altcoins. You might relate this to a local market scenario where shoppers flock to one stall over others, indicating trust in its offerings. Monitoring the BDI can help you‘d anticipate market movements and strategize accordingly.</p>

<h2>Implications of DeFi Regulation on the Bitcoin Dominance Index</h2>

<p>With the rise of decentralized finance (DeFi) platforms, Bitcoin‘s market influence may change significantly. New regulations coming in 2025, especially in markets like Singapore, could also lead to fluctuations in Bitcoin‘s dominance. It’s similar to a new store opening in your neighborhood – it could either draw more customers to the area or shift focus away from existing stores, impacting everyone involved.</p>

<h2>What Factors Influence the Bitcoin Dominance Index?</h2>

<p>Several factors can affect the BDI including market sentiment, the emergence of new technology like cross–chain interoperability, and the adoption of proof–of–stake (PoS) mechanisms. Imagine a neighborhood block party where everyone is invited; if one resident starts providing free food, parties would shift focus to their place, all contributing to a change in dynamics. Similarly, shifts in technology can tilt the Bitcoin dominance index.</p>

<p>In conclusion, understanding the Bitcoin dominance index is vital for navigating the evolving cryptocurrency landscape. If you want to gain deeper insights, download our comprehensive toolkit to enhance your trading strategies!</p>

<p style=“font–weight:bold;“>Download the toolkit here!</p>

<p style=“font–style:italic;“>Disclaimer: This article does not constitute investment advice. Consult your local regulatory authority, such as the MAS or SEC, before making any trading decisions. Tools like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.</p>

<p>Explore more about cross–chain mechanisms and DeFi guidelines at <a href=“https://hibt.com“>hibt.com</a>. Check out our <a href=“https://hibt.com/cross–chain–whitepaper“>Cross–chain security white paper</a> for detailed insights.</p>

<p style=“text–align:right;“><em>OKHTX</em></p>