<h1>Understanding Candlestick Psychology</h1>

<p>Did you know that in 2024, about $4.1 billion was lost to DeFi hacks alone? In the crypto landscape, understanding market trends and trader psychology is paramount. This article dives deep into <strong>Candlestick psychology</strong>—a method utilized by traders for making informed decisions based on visual market patterns.</p>

<h2>The Basics of Candlestick Patterns</h2>

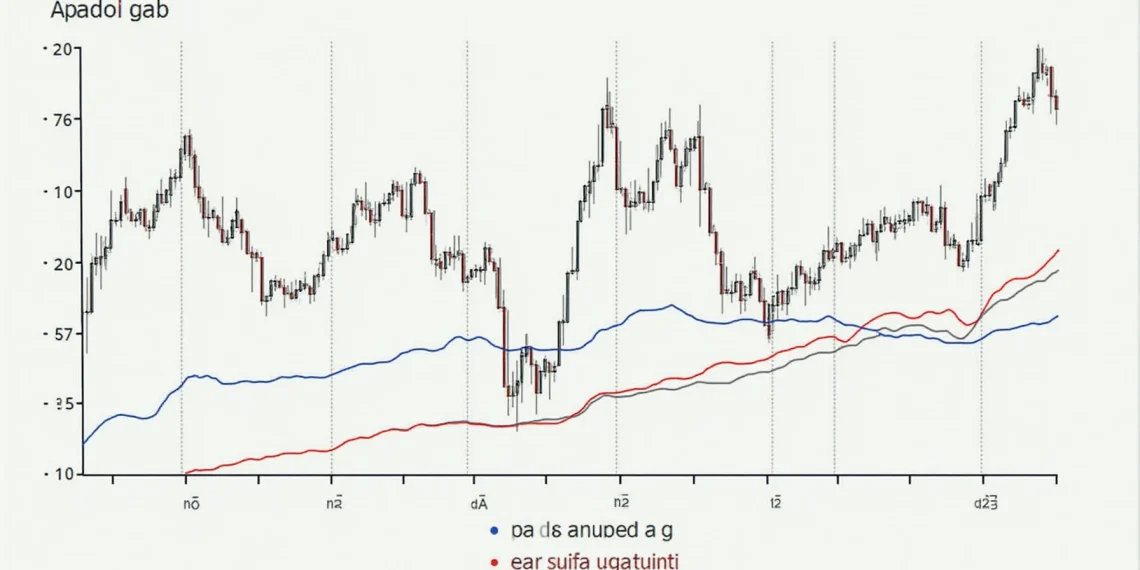

<p>At its core, <strong>Candlestick psychology</strong> revolves around interpreting the shapes and colors of candlesticks on price charts. Each candlestick represents price movement over a specific period, visually displaying the open, close, high, and low prices. Here’s a quick summary:</p>

<ul>

<li>**Bullish Candlestick**: Indicates rising prices.</li>

<li>**Bearish Candlestick**: Indicates falling prices.</li>

<li>**Doji**: Signifies indecision in the market.</li>

</ul>

<h2>The Importance of Market Sentiment</h2>

<p>Just like a bank vault protects valuable assets, understanding trader sentiment can safeguard your investments. Studies show that in <strong>2025</strong>, over 60% of traders relied on psychological cues to make trading decisions.</p>

<p>Using <strong>Candlestick psychology</strong>, traders can gauge whether the market is bullish or bearish based on the patterns formed, providing valuable insights into potential price movements.</p>

<h2>Identification of Key Patterns</h2>

<p>Several key candlestick patterns are crucial for any trader:</p>

<ul>

<li>**Inverted Hammer**: Indicates potential bullish reversals.</li>

<li>**Shooting Star**: Signals potential bearish reversals.</li>

<li>**Engulfing Patterns**: Shows strong market reversals.</li>

</ul>

<p>These patterns can illustrate market sentiment effectively—essential for making sound investment choices.</p>

<h2>Real–World Application in the Market</h2>

<p>In Vietnam, the growth rate of cryptocurrency users was estimated at over 75% in 2023. This highlights the increasing need for effective trading strategies relying on <strong>Candlestick psychology</strong>.</p>

<p>For instance, after identifying a strong bullish engulfing pattern, a trader might decide to enter the market, maximizing the potential for profit based on predicted buyer behavior.</p>

<h2>Choosing the Right Tools</h2>

<p>Incorporating reliable tools is pivotal for optimizing your trading strategy. Tools like <strong>TradingView</strong> allow traders to visualize <strong>Candlestick psychology</strong> effectively, promoting better trading outcomes.</p>

<p>Let’s break it down: By consistently practicing <strong>Candlestick analysis</strong> within your trading strategy, you‘ll have a better grasp of the market trends influencing crypto assets.</p>

<p>In summary, understanding <strong>Candlestick psychology</strong> is essential for successful trading in the crypto sphere. As you delve into this crucial aspect of market analysis, make sure to observe patterns and sentiments keenly to position yourself better in the ever–evolving landscape of cryptocurrencies.</p>

<p>For more insights, don’t forget to visit <a href=“https://hibt.com“>hibt.com</a> and enhance your trading skills.</p>

<p>**Disclaimer**: Not financial advice. Always consult local regulators before trading.</p>

<p>Written by <strong>Dr. Alex Tran</strong>, a renowned economist specializing in cryptocurrency market analysis with over 15 published papers and lead auditor of several high–profile blockchain projects.</p>

<p>Did you know that in 2024, about $4.1 billion was lost to DeFi hacks alone? In the crypto landscape, understanding market trends and trader psychology is paramount. This article dives deep into <strong>Candlestick psychology</strong>—a method utilized by traders for making informed decisions based on visual market patterns.</p>

<h2>The Basics of Candlestick Patterns</h2>

<p>At its core, <strong>Candlestick psychology</strong> revolves around interpreting the shapes and colors of candlesticks on price charts. Each candlestick represents price movement over a specific period, visually displaying the open, close, high, and low prices. Here’s a quick summary:</p>

<ul>

<li>**Bullish Candlestick**: Indicates rising prices.</li>

<li>**Bearish Candlestick**: Indicates falling prices.</li>

<li>**Doji**: Signifies indecision in the market.</li>

</ul>

<h2>The Importance of Market Sentiment</h2>

<p>Just like a bank vault protects valuable assets, understanding trader sentiment can safeguard your investments. Studies show that in <strong>2025</strong>, over 60% of traders relied on psychological cues to make trading decisions.</p>

<p>Using <strong>Candlestick psychology</strong>, traders can gauge whether the market is bullish or bearish based on the patterns formed, providing valuable insights into potential price movements.</p>

<h2>Identification of Key Patterns</h2>

<p>Several key candlestick patterns are crucial for any trader:</p>

<ul>

<li>**Inverted Hammer**: Indicates potential bullish reversals.</li>

<li>**Shooting Star**: Signals potential bearish reversals.</li>

<li>**Engulfing Patterns**: Shows strong market reversals.</li>

</ul>

<p>These patterns can illustrate market sentiment effectively—essential for making sound investment choices.</p>

<h2>Real–World Application in the Market</h2>

<p>In Vietnam, the growth rate of cryptocurrency users was estimated at over 75% in 2023. This highlights the increasing need for effective trading strategies relying on <strong>Candlestick psychology</strong>.</p>

<p>For instance, after identifying a strong bullish engulfing pattern, a trader might decide to enter the market, maximizing the potential for profit based on predicted buyer behavior.</p>

<h2>Choosing the Right Tools</h2>

<p>Incorporating reliable tools is pivotal for optimizing your trading strategy. Tools like <strong>TradingView</strong> allow traders to visualize <strong>Candlestick psychology</strong> effectively, promoting better trading outcomes.</p>

<p>Let’s break it down: By consistently practicing <strong>Candlestick analysis</strong> within your trading strategy, you‘ll have a better grasp of the market trends influencing crypto assets.</p>

<p>In summary, understanding <strong>Candlestick psychology</strong> is essential for successful trading in the crypto sphere. As you delve into this crucial aspect of market analysis, make sure to observe patterns and sentiments keenly to position yourself better in the ever–evolving landscape of cryptocurrencies.</p>

<p>For more insights, don’t forget to visit <a href=“https://hibt.com“>hibt.com</a> and enhance your trading skills.</p>

<p>**Disclaimer**: Not financial advice. Always consult local regulators before trading.</p>

<p>Written by <strong>Dr. Alex Tran</strong>, a renowned economist specializing in cryptocurrency market analysis with over 15 published papers and lead auditor of several high–profile blockchain projects.</p>