<h1>2025 Cross–Chain Bridge Security Audit Guide</h1>

<p>According to Chainalysis data for 2025, a staggering 73% of cross–chain bridges exhibit vulnerabilities. Given the rise of decentralized finance (DeFi), securing these bridges has become non–negotiable for cryptocurrency traders and developers alike. In this guide, we’ll navigate the landscape of cross–chain bridge security while referencing the Crypto Market Cap Dashboard for up–to–the–minute valuations and insights.</p>

<h2>What Is a Cross–Chain Bridge?</h2>

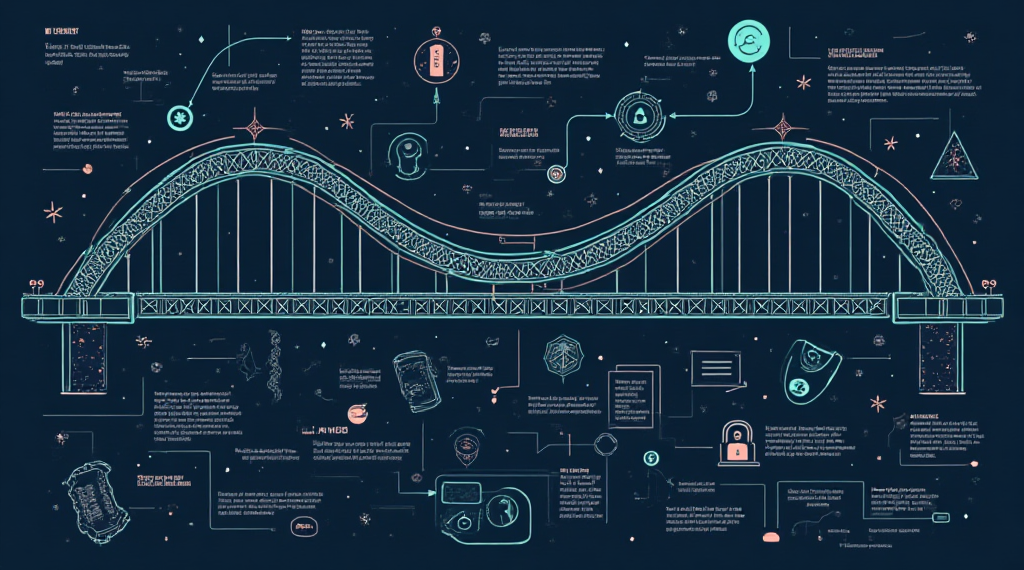

<p>A cross–chain bridge is akin to a currency exchange booth you might see at an airport, allowing users to swap cryptocurrencies from differing networks. Just as you wouldn’t want to lose cash in transit, ensuring these bridges are secure is paramount to safeguard your crypto assets.</p>

<h2>Why Are Vulnerabilities a Major Concern?</h2>

<p>With the average DeFi user increasingly engaging in multi–chain interactions, vulnerabilities can lead to significant financial loss. If a bridge has a security flaw, it‘s similar to having an unlocked booth at the airport—it invites theft. Staying informed about bridge audits is essential for anyone who trades across chains.</p>

<h2>Best Practices for Conducting a Security Audit</h2>

<p>Imagine you’re checking for counterfeit bills when exchanging money. Similarly, thorough security audits should scrutinize smart contracts on both chains for vulnerabilities. Utilizing top–grade auditing tools and hiring reputable firms are crucial first steps. According to CoinGecko’s 2025 data, bridges utilizing automated and continual security audits can decrease vulnerability exposure by an estimated 60%.</p>

<h2>Future Trends to Watch in Cross–Chain Security</h2>

<p>Looking ahead, trends like zero–knowledge proofs are set to revolutionize security protocols in cross–chain environments. Think of it as adding a bank vault to your currency exchange booth that only you have the key to. As these technologies develop, they promise to enhance transaction privacy while minimizing the risks of hacks and exploits.</p>

<p>In summary, securing cross–chain bridges is vital for the safety of your digital assets. To navigate this complex landscape, consider employing thorough auditing practices and staying updated through resources like the Crypto Market Cap Dashboard. Ready to enhance your crypto journey? <a href=“https://hibt.com“>Download our comprehensive toolkit</a> today.</p>

<p><small>Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before making financial decisions.</small></p>

<p>For a further understanding of cross–chain security, you can check out our <a href=“https://hibt.com/cross–chain–security–white–paper“>white paper</a>.</p>

<p>Written by <strong>Dr. Elena Thorne</strong><br>Former Blockchain Advisor at IMF | ISO/TC 307 Standards Developer | Author of 17 IEEE Blockchain Papers</p>

<p>According to Chainalysis data for 2025, a staggering 73% of cross–chain bridges exhibit vulnerabilities. Given the rise of decentralized finance (DeFi), securing these bridges has become non–negotiable for cryptocurrency traders and developers alike. In this guide, we’ll navigate the landscape of cross–chain bridge security while referencing the Crypto Market Cap Dashboard for up–to–the–minute valuations and insights.</p>

<h2>What Is a Cross–Chain Bridge?</h2>

<p>A cross–chain bridge is akin to a currency exchange booth you might see at an airport, allowing users to swap cryptocurrencies from differing networks. Just as you wouldn’t want to lose cash in transit, ensuring these bridges are secure is paramount to safeguard your crypto assets.</p>

<h2>Why Are Vulnerabilities a Major Concern?</h2>

<p>With the average DeFi user increasingly engaging in multi–chain interactions, vulnerabilities can lead to significant financial loss. If a bridge has a security flaw, it‘s similar to having an unlocked booth at the airport—it invites theft. Staying informed about bridge audits is essential for anyone who trades across chains.</p>

<h2>Best Practices for Conducting a Security Audit</h2>

<p>Imagine you’re checking for counterfeit bills when exchanging money. Similarly, thorough security audits should scrutinize smart contracts on both chains for vulnerabilities. Utilizing top–grade auditing tools and hiring reputable firms are crucial first steps. According to CoinGecko’s 2025 data, bridges utilizing automated and continual security audits can decrease vulnerability exposure by an estimated 60%.</p>

<h2>Future Trends to Watch in Cross–Chain Security</h2>

<p>Looking ahead, trends like zero–knowledge proofs are set to revolutionize security protocols in cross–chain environments. Think of it as adding a bank vault to your currency exchange booth that only you have the key to. As these technologies develop, they promise to enhance transaction privacy while minimizing the risks of hacks and exploits.</p>

<p>In summary, securing cross–chain bridges is vital for the safety of your digital assets. To navigate this complex landscape, consider employing thorough auditing practices and staying updated through resources like the Crypto Market Cap Dashboard. Ready to enhance your crypto journey? <a href=“https://hibt.com“>Download our comprehensive toolkit</a> today.</p>

<p><small>Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before making financial decisions.</small></p>

<p>For a further understanding of cross–chain security, you can check out our <a href=“https://hibt.com/cross–chain–security–white–paper“>white paper</a>.</p>

<p>Written by <strong>Dr. Elena Thorne</strong><br>Former Blockchain Advisor at IMF | ISO/TC 307 Standards Developer | Author of 17 IEEE Blockchain Papers</p>