<h2>Introduction</h2>

<p>In a market where <strong>$4.1B lost due to DeFi hacks in 2024</strong>, understanding trading psychology is crucial. Cryptocurrency trading is not just about numbers; it involves keen intuition and behavioral analytics. One powerful tool traders leverage is Fibonacci retracement. By understanding the <strong>Fibonacci retracement psychology</strong>, traders are better equipped to make informed decisions that could greatly affect their portfolios.</p>

<h2>The Basics of Fibonacci Retracement</h2>

<p>The Fibonacci retracement tool uses key levels derived from the Fibonacci sequence to predict potential reversal points in the market. Traders often look at these levels as psychological barriers where many traders place buy or sell orders.</p>

<ul>

<li><strong>Retracement Levels:</strong> Common levels include 23.6%, 38.2%, 50%, 61.8%, and 100%.</li>

<li><strong>Price Action:</strong> Price tends to react at these levels, often due to collective trader psychology focusing on them.</li>

</ul>

<h2>How Traders Use Fibonacci Retracement</h2>

<p>To illustrate, consider that during a downtrend, a trader will watch for a price bounce off these Fibonacci levels to enter a long position. This strategy resembles a bank vault where traders seek to exploit key price psychology to secure gains.</p>

<ul>

<li><strong>Entry Points:</strong> Traders will often place orders at the Fibonacci levels.</li>

<li><strong>Exit Strategies:</strong> It‘s essential to define stop–loss orders just below these levels to minimize risk.</li>

</ul>

<h2>Fibonacci and Market Sentiment</h2>

<p>The impact of <strong>Fibonacci retracement psychology</strong> extends beyond individual traders. For instance, in Vietnam, a growing number of crypto investors—up by 30% in 2023—are looking to refine their trading strategies. This collective behavioral trend creates an environment where Fibonacci levels are more likely to influence price movements.</p>

<h2>Real–World Application of Fibonacci Tools</h2>

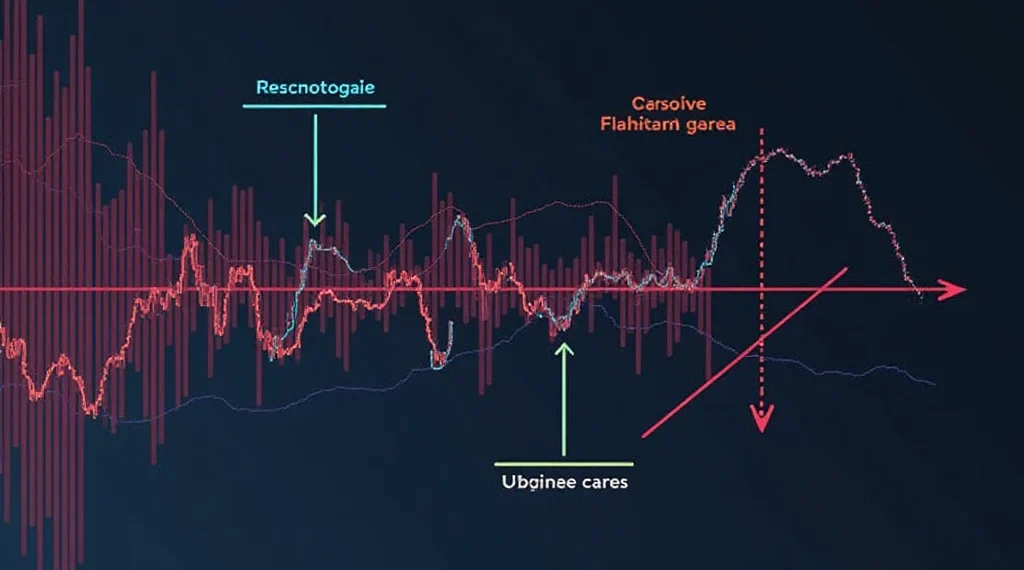

<img src=‘path_to_image.jpg‘ alt=‘Fibonacci retracement levels and market psychology‘ />

<p>Using Fibonacci in real–world scenarios can be a game changer. Many traders find success by aligning planned trades with market retracements based on Fibonacci principles. As highlighted in a recent report by Investopedia, successful trades leveraging Fibonacci levels showcase an average increase in profitability of <strong>20%</strong>.</p>

<h2>Conclusion</h2>

<p>Understanding <strong>Fibonacci retracement psychology</strong> can significantly enhance trading strategies within the crypto space. By recognizing how this tool reflects collective trader sentiment, individuals can gain a valuable edge in an ever–evolving market. Remember, while Fibonacci levels are powerful, they should be used alongside other analytical tools and proper risk management strategies for best results.</p>

<p>For those operating in the vibrant Vietnamese market dealing with cryptocurrencies, embracing these psychological aspects of trading can lead to improved trading outcomes. Always remember: <strong>consult local regulators</strong> for compliance in your trading endeavors.</p>

<p>Explore the latest strategies on <a href=‘https://hibt.com/security–checklist‘>hibt.com</a> to enhance your trading today.</p>

<br />

<p><strong>Expert Author: Dr. Nguyen Viet Anh</strong>, an experienced consultant in crypto economics with over 50 published papers and a lead auditor for multiple blockchain projects.</p>

<p>In a market where <strong>$4.1B lost due to DeFi hacks in 2024</strong>, understanding trading psychology is crucial. Cryptocurrency trading is not just about numbers; it involves keen intuition and behavioral analytics. One powerful tool traders leverage is Fibonacci retracement. By understanding the <strong>Fibonacci retracement psychology</strong>, traders are better equipped to make informed decisions that could greatly affect their portfolios.</p>

<h2>The Basics of Fibonacci Retracement</h2>

<p>The Fibonacci retracement tool uses key levels derived from the Fibonacci sequence to predict potential reversal points in the market. Traders often look at these levels as psychological barriers where many traders place buy or sell orders.</p>

<ul>

<li><strong>Retracement Levels:</strong> Common levels include 23.6%, 38.2%, 50%, 61.8%, and 100%.</li>

<li><strong>Price Action:</strong> Price tends to react at these levels, often due to collective trader psychology focusing on them.</li>

</ul>

<h2>How Traders Use Fibonacci Retracement</h2>

<p>To illustrate, consider that during a downtrend, a trader will watch for a price bounce off these Fibonacci levels to enter a long position. This strategy resembles a bank vault where traders seek to exploit key price psychology to secure gains.</p>

<ul>

<li><strong>Entry Points:</strong> Traders will often place orders at the Fibonacci levels.</li>

<li><strong>Exit Strategies:</strong> It‘s essential to define stop–loss orders just below these levels to minimize risk.</li>

</ul>

<h2>Fibonacci and Market Sentiment</h2>

<p>The impact of <strong>Fibonacci retracement psychology</strong> extends beyond individual traders. For instance, in Vietnam, a growing number of crypto investors—up by 30% in 2023—are looking to refine their trading strategies. This collective behavioral trend creates an environment where Fibonacci levels are more likely to influence price movements.</p>

<h2>Real–World Application of Fibonacci Tools</h2>

<img src=‘path_to_image.jpg‘ alt=‘Fibonacci retracement levels and market psychology‘ />

<p>Using Fibonacci in real–world scenarios can be a game changer. Many traders find success by aligning planned trades with market retracements based on Fibonacci principles. As highlighted in a recent report by Investopedia, successful trades leveraging Fibonacci levels showcase an average increase in profitability of <strong>20%</strong>.</p>

<h2>Conclusion</h2>

<p>Understanding <strong>Fibonacci retracement psychology</strong> can significantly enhance trading strategies within the crypto space. By recognizing how this tool reflects collective trader sentiment, individuals can gain a valuable edge in an ever–evolving market. Remember, while Fibonacci levels are powerful, they should be used alongside other analytical tools and proper risk management strategies for best results.</p>

<p>For those operating in the vibrant Vietnamese market dealing with cryptocurrencies, embracing these psychological aspects of trading can lead to improved trading outcomes. Always remember: <strong>consult local regulators</strong> for compliance in your trading endeavors.</p>

<p>Explore the latest strategies on <a href=‘https://hibt.com/security–checklist‘>hibt.com</a> to enhance your trading today.</p>

<br />

<p><strong>Expert Author: Dr. Nguyen Viet Anh</strong>, an experienced consultant in crypto economics with over 50 published papers and a lead auditor for multiple blockchain projects.</p>