<h1>2025 Cross–Chain Bridge Security Audit Guide</h1>

<p>According to Chainalysis 2025 data, a staggering 73% of cross–chain bridges are vulnerable to attacks, raising concerns over the safety of liquidity pools and TVL (Total Value Locked) in decentralized finance (DeFi).</p>

<h2>Understanding Cross–Chain Bridges</h2>

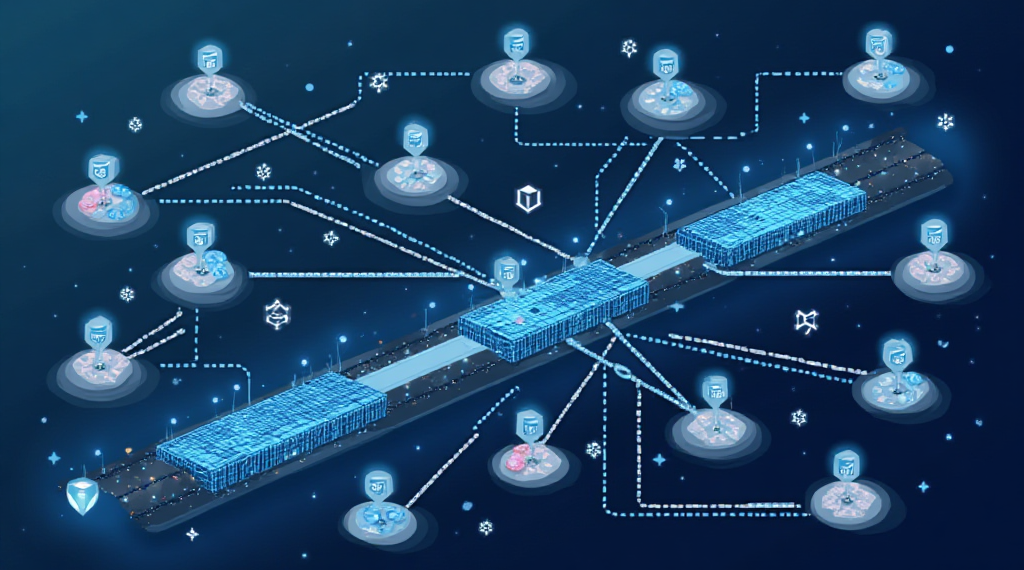

<p>Think of cross–chain bridges like currency exchange kiosks at the airport. Just like you swap your dollars for euros, cross–chain bridges allow you to exchange assets across different blockchain networks. But just like not every currency exchange is trustworthy, not every bridge is secure.</p>

<h2>The Importance of TVL in DeFi</h2>

<p>Total Value Locked, or TVL, is the lifeblood of liquidity pools. It measures the amount of cryptocurrency staked in DeFi protocols. More TVL means more liquidity available for trades and transactions, which enhances the overall functionality of the DeFi ecosystem.</p>

<h2>2025 Regulatory Trends in Singapore</h2>

<p>The regulatory landscape for DeFi is evolving rapidly, especially in regions like Singapore. By 2025, we can expect stricter regulations aimed at ensuring the security of liquidity pools and protecting investors. Staying updated on these regulations is crucial for participating safely in the DeFi space.</p>

<h2>Proof of Stake vs. Environmental Concerns</h2>

<p>As we move towards sustainable blockchain solutions, comparing the energy consumption of Proof of Stake (PoS) mechanisms with traditional Proof of Work (PoW) systems becomes essential. PoS can drastically reduce energy use, promoting a greener approach to maintaining liquidity pools.</p>

<p>In conclusion, understanding liquidity pools and TVL is vital for navigating the DeFi landscape safely. To delve deeper into this subject, download our comprehensive toolkit and arm yourself with the right knowledge.</p>

<p><a href=“https://hibt.com/deep–dive–into–tvl“>Download the toolkit now!</a></p>

<p><strong>Risk Disclaimer:</strong> This article does not constitute investment advice. Please consult local regulations before making any investment decisions.</p>

<p>For more insights on cross–chain security, check out our <a href=“https://hibt.com/cross–chain–security–whitepaper“>white paper.</a></p>

<p><em>Powered by OKHTX</em></p>

<p>According to Chainalysis 2025 data, a staggering 73% of cross–chain bridges are vulnerable to attacks, raising concerns over the safety of liquidity pools and TVL (Total Value Locked) in decentralized finance (DeFi).</p>

<h2>Understanding Cross–Chain Bridges</h2>

<p>Think of cross–chain bridges like currency exchange kiosks at the airport. Just like you swap your dollars for euros, cross–chain bridges allow you to exchange assets across different blockchain networks. But just like not every currency exchange is trustworthy, not every bridge is secure.</p>

<h2>The Importance of TVL in DeFi</h2>

<p>Total Value Locked, or TVL, is the lifeblood of liquidity pools. It measures the amount of cryptocurrency staked in DeFi protocols. More TVL means more liquidity available for trades and transactions, which enhances the overall functionality of the DeFi ecosystem.</p>

<h2>2025 Regulatory Trends in Singapore</h2>

<p>The regulatory landscape for DeFi is evolving rapidly, especially in regions like Singapore. By 2025, we can expect stricter regulations aimed at ensuring the security of liquidity pools and protecting investors. Staying updated on these regulations is crucial for participating safely in the DeFi space.</p>

<h2>Proof of Stake vs. Environmental Concerns</h2>

<p>As we move towards sustainable blockchain solutions, comparing the energy consumption of Proof of Stake (PoS) mechanisms with traditional Proof of Work (PoW) systems becomes essential. PoS can drastically reduce energy use, promoting a greener approach to maintaining liquidity pools.</p>

<p>In conclusion, understanding liquidity pools and TVL is vital for navigating the DeFi landscape safely. To delve deeper into this subject, download our comprehensive toolkit and arm yourself with the right knowledge.</p>

<p><a href=“https://hibt.com/deep–dive–into–tvl“>Download the toolkit now!</a></p>

<p><strong>Risk Disclaimer:</strong> This article does not constitute investment advice. Please consult local regulations before making any investment decisions.</p>

<p>For more insights on cross–chain security, check out our <a href=“https://hibt.com/cross–chain–security–whitepaper“>white paper.</a></p>

<p><em>Powered by OKHTX</em></p>