<h1>Market Cycle Emotions: Navigating the Cryptosphere</h1>

<p>In the volatile world of cryptocurrencies, emotions often dictate market behaviors. With the total market cap reaching a staggering $2.1 trillion in early 2023, understanding market cycle emotions has never been more crucial for investors.</p>

<h2>Understanding Market Cycles</h2>

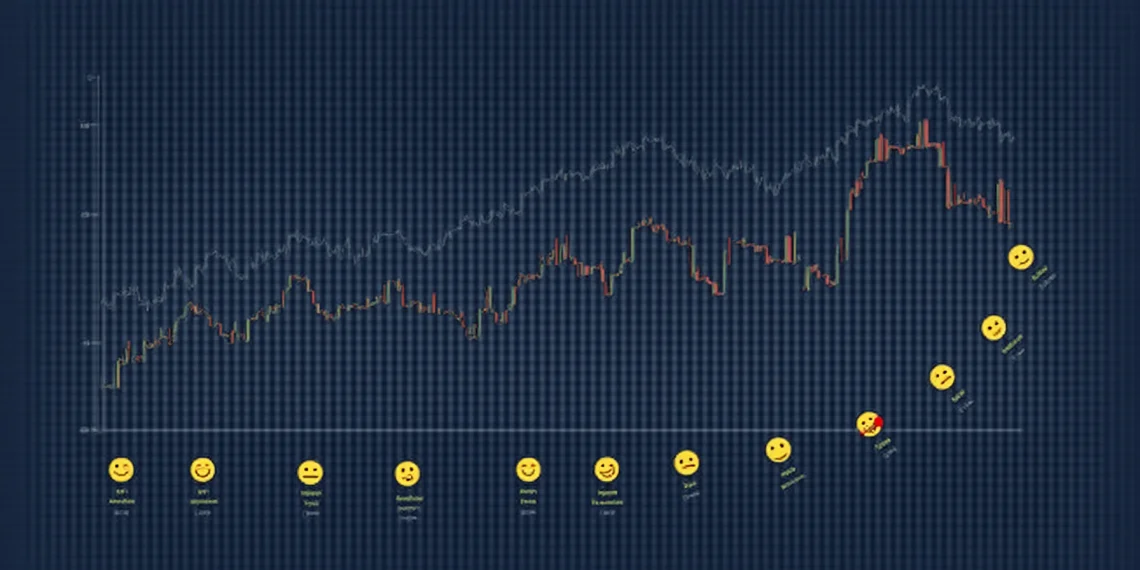

<p>Market cycles consist of phases: <strong>accumulation</strong>, <strong>uptrend</strong>, <strong>distribution</strong>, and <strong>downtrend</strong>. Each phase elicits specific emotions. For example, during the accumulation phase, investors feel optimism as prices become attractive. Conversely, in a downtrend, fear permeates the market.</p>

<h3>Emotions in Each Phase</h3>

<ul>

<li><strong>Accumulation:</strong> Hope prevails as savvy investors start buying.</li>

<li><strong>Uptrend:</strong> Excitement and euphoria can lead to significant investments.</li>

<li><strong>Distribution:</strong> Anxiety begins to surface as the market peaks.</li>

<li><strong>Downtrend:</strong> Fear and despair dominate behavior, causing panic selling.</li>

</ul>

<h2>The Role of Social Media</h2>

<p>Platforms like Twitter and Telegram amplify emotions, as prices fluctuate rapidly based on online sentiment. It‘s akin to a rumor mill; one tweet can send prices soaring or plummeting. This phenomenon is visible in the Vietnamese market, where crypto users have surged by <strong>72% from 2021 to 2023</strong>.</p>

<h3>Case Study: Bitcoin‘s Bull Runs</h3>

<p>Consider Bitcoin‘s major bull runs in 2021 and 2023: excitement reached a fever pitch, leading even novice investors to jump in. However, the subsequent corrections birthed despair as losses piled up. Investors must learn to manage their emotions, as often the best strategy is to remain calm amidst chaos.</p>

<h2>Navigating Market Emotions Effectively</h2>

<p>So, how can investors navigate these emotions? Here are a few tips:</p>

<ul>

<li><strong>Educate Yourself:</strong> Understand market fundamentals and the technology behind cryptocurrencies.</li>

<li><strong>Set Clear Goals:</strong> Know your risk tolerance and investment horizon.</li>

<li><strong>Diversify:</strong> Spread your investments to manage risk.</li>

<li><strong>Use Tools:</strong> Platforms like <a href=“https://hibt.com“>hibt.com</a> provide insights to help mitigate emotional trading.</li>

</ul>

<h2>Conclusion</h2>

<p>Recognizing and understanding market cycle emotions can empower investors to make smarter choices. By remaining level–headed and informed, individuals can thrive in the ever–evolving crypto landscape. Just like in any investment, the key is not to allow feelings to dictate decisions—especially in the unpredictable world of cryptocurrencies. For further insights, check out our resources at OKHTX.</p>

<p>Author: Dr. Minh Nguyen, a blockchain economics researcher with over <strong>30 published papers</strong> and a lead auditor on projects like <strong>ETH2.0</strong>.</p>

<p>In the volatile world of cryptocurrencies, emotions often dictate market behaviors. With the total market cap reaching a staggering $2.1 trillion in early 2023, understanding market cycle emotions has never been more crucial for investors.</p>

<h2>Understanding Market Cycles</h2>

<p>Market cycles consist of phases: <strong>accumulation</strong>, <strong>uptrend</strong>, <strong>distribution</strong>, and <strong>downtrend</strong>. Each phase elicits specific emotions. For example, during the accumulation phase, investors feel optimism as prices become attractive. Conversely, in a downtrend, fear permeates the market.</p>

<h3>Emotions in Each Phase</h3>

<ul>

<li><strong>Accumulation:</strong> Hope prevails as savvy investors start buying.</li>

<li><strong>Uptrend:</strong> Excitement and euphoria can lead to significant investments.</li>

<li><strong>Distribution:</strong> Anxiety begins to surface as the market peaks.</li>

<li><strong>Downtrend:</strong> Fear and despair dominate behavior, causing panic selling.</li>

</ul>

<h2>The Role of Social Media</h2>

<p>Platforms like Twitter and Telegram amplify emotions, as prices fluctuate rapidly based on online sentiment. It‘s akin to a rumor mill; one tweet can send prices soaring or plummeting. This phenomenon is visible in the Vietnamese market, where crypto users have surged by <strong>72% from 2021 to 2023</strong>.</p>

<h3>Case Study: Bitcoin‘s Bull Runs</h3>

<p>Consider Bitcoin‘s major bull runs in 2021 and 2023: excitement reached a fever pitch, leading even novice investors to jump in. However, the subsequent corrections birthed despair as losses piled up. Investors must learn to manage their emotions, as often the best strategy is to remain calm amidst chaos.</p>

<h2>Navigating Market Emotions Effectively</h2>

<p>So, how can investors navigate these emotions? Here are a few tips:</p>

<ul>

<li><strong>Educate Yourself:</strong> Understand market fundamentals and the technology behind cryptocurrencies.</li>

<li><strong>Set Clear Goals:</strong> Know your risk tolerance and investment horizon.</li>

<li><strong>Diversify:</strong> Spread your investments to manage risk.</li>

<li><strong>Use Tools:</strong> Platforms like <a href=“https://hibt.com“>hibt.com</a> provide insights to help mitigate emotional trading.</li>

</ul>

<h2>Conclusion</h2>

<p>Recognizing and understanding market cycle emotions can empower investors to make smarter choices. By remaining level–headed and informed, individuals can thrive in the ever–evolving crypto landscape. Just like in any investment, the key is not to allow feelings to dictate decisions—especially in the unpredictable world of cryptocurrencies. For further insights, check out our resources at OKHTX.</p>

<p>Author: Dr. Minh Nguyen, a blockchain economics researcher with over <strong>30 published papers</strong> and a lead auditor on projects like <strong>ETH2.0</strong>.</p>