<h1>2025 Interoperability Proof: Bridging Chains for Secure Transactions</h1>

<p>In light of Chainalysis 2025 data, did you know that 73% of global cross–chain bridges currently have security vulnerabilities? As the financial landscape evolves, understanding how to secure these transactions becomes paramount. This article examines the crucial elements of cross–chain interoperability, the application of zero–knowledge proofs, and the emerging regulations shaped by future trends.</p>

<h2>1. What is Cross–Chain Interoperability?</h2>

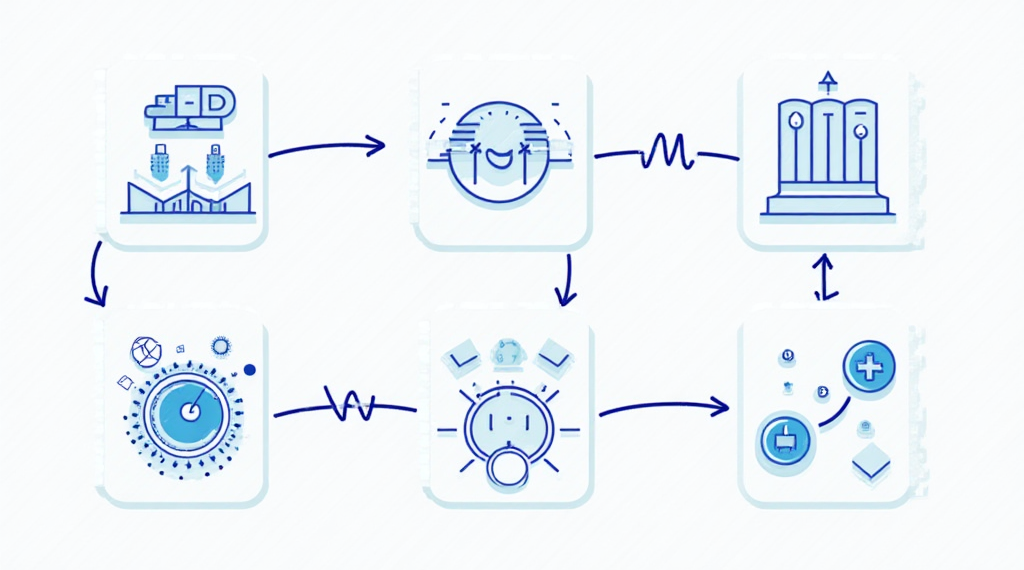

<p>To put it simply, cross–chain interoperability is like a currency exchange booth at a market, allowing different cryptocurrencies to communicate seamlessly. In 2025, as more platforms look to interact, understanding this concept is essential to ensure smooth and secure transfers.</p>

<h2>2. How Do Zero–Knowledge Proofs Enhance Security?</h2>

<p>Think of zero–knowledge proofs as a way to show you have a ticket without revealing your identity. It allows transactions between chains while keeping sensitive information private. This technology could potentially reduce fraud and increase trust among users in an increasingly decentralized finance (DeFi) environment.</p>

<h2>3. What Are the Regulation Trends for DeFi in Singapore?</h2>

<p>You may have heard about new regulations affecting DeFi in Singapore by 2025. These regulations aim to foster innovation while ensuring user protection. Understanding local laws is crucial, so think of it as checking the rules before placing a bet at a casino.</p>

<h2>4. Energy Consumption Comparison: PoS vs. PoW Mechanisms</h2>

<p>Imagine two vendors at a market; one uses solar panels (PoS), while the other burns coal (PoW). PoS is significantly more energy–efficient, making it an attractive choice for new projects and environments. Understanding this can help stakeholders make informed decisions about which mechanisms to adopt in their strategies.</p>

<p>As we conclude, it is vital to adopt tools that can improve the security of your digital assets. Download our comprehensive toolkit for best practices in blockchain security now.</p>

<p><strong>Disclaimer:</strong> This article does not constitute investment advice. Please consult local regulatory bodies like MAS or SEC before proceeding with transactions.</p>

<p>For further insights, access the <a href=“https://hibt.com/cross–chain–security–whitepaper“>Cross–Chain Security White Paper</a> and enhance your understanding of this essential topic.</p>

<p>Protect your assets with Ledger Nano X to reduce the risk of private key exposure by up to 70%.</p>

<p>– OKHTX</p>

<p>In light of Chainalysis 2025 data, did you know that 73% of global cross–chain bridges currently have security vulnerabilities? As the financial landscape evolves, understanding how to secure these transactions becomes paramount. This article examines the crucial elements of cross–chain interoperability, the application of zero–knowledge proofs, and the emerging regulations shaped by future trends.</p>

<h2>1. What is Cross–Chain Interoperability?</h2>

<p>To put it simply, cross–chain interoperability is like a currency exchange booth at a market, allowing different cryptocurrencies to communicate seamlessly. In 2025, as more platforms look to interact, understanding this concept is essential to ensure smooth and secure transfers.</p>

<h2>2. How Do Zero–Knowledge Proofs Enhance Security?</h2>

<p>Think of zero–knowledge proofs as a way to show you have a ticket without revealing your identity. It allows transactions between chains while keeping sensitive information private. This technology could potentially reduce fraud and increase trust among users in an increasingly decentralized finance (DeFi) environment.</p>

<h2>3. What Are the Regulation Trends for DeFi in Singapore?</h2>

<p>You may have heard about new regulations affecting DeFi in Singapore by 2025. These regulations aim to foster innovation while ensuring user protection. Understanding local laws is crucial, so think of it as checking the rules before placing a bet at a casino.</p>

<h2>4. Energy Consumption Comparison: PoS vs. PoW Mechanisms</h2>

<p>Imagine two vendors at a market; one uses solar panels (PoS), while the other burns coal (PoW). PoS is significantly more energy–efficient, making it an attractive choice for new projects and environments. Understanding this can help stakeholders make informed decisions about which mechanisms to adopt in their strategies.</p>

<p>As we conclude, it is vital to adopt tools that can improve the security of your digital assets. Download our comprehensive toolkit for best practices in blockchain security now.</p>

<p><strong>Disclaimer:</strong> This article does not constitute investment advice. Please consult local regulatory bodies like MAS or SEC before proceeding with transactions.</p>

<p>For further insights, access the <a href=“https://hibt.com/cross–chain–security–whitepaper“>Cross–Chain Security White Paper</a> and enhance your understanding of this essential topic.</p>

<p>Protect your assets with Ledger Nano X to reduce the risk of private key exposure by up to 70%.</p>

<p>– OKHTX</p>