Financial markets play a crucial role in the global economy by facilitating the exchange of funds and assets. They enable businesses, governments, and individuals to raise capital, invest, and manage risks. In this article, we will delve into the different types of financial markets, their significance, and how they function within the broader economy. Whether you’re a novice investor or a seasoned financial professional, understanding the basics of financial markets is essential for navigating the world of investments and economic growth.

What Are Financial Markets?

Financial markets are platforms where buyers and sellers come together to trade financial assets, such as stocks, bonds, commodities, and currencies. These markets provide a structured environment for the exchange of funds, ensuring liquidity and price discovery. They enable businesses to raise capital through the issuance of shares or bonds, allow investors to buy and sell assets, and facilitate the management of economic risks, such as inflation or interest rate changes.

The primary purpose of financial markets is to allocate resources efficiently by matching individuals or organizations with surplus funds (investors) to those with a deficit (borrowers or issuers). By doing so, they contribute to the overall economic stability and growth.

Types of Financial Markets

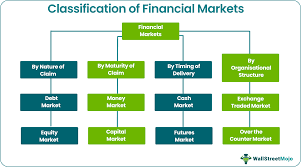

Financial markets can be broadly classified into several categories, each serving a unique purpose in the economy. The major types of financial markets include:

1. Capital Markets

Capital markets are markets for buying and selling long-term debt and equity instruments, typically with maturities of more than one year. These markets are crucial for businesses and governments looking to raise funds for long-term investments. Capital markets are divided into two subcategories:

- Stock Markets: In stock markets, companies issue shares of stock to raise equity capital. Investors purchase these shares, and the value of the shares fluctuates based on the company’s performance and market conditions. Stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ are the most well-known examples of stock markets.

- Bond Markets: Bond markets, on the other hand, deal with the buying and selling of debt securities. Governments and corporations issue bonds to borrow money for a fixed period, and bondholders receive interest payments in return. The bond market helps governments and corporations access capital while providing investors with a relatively stable income source.

2. Money Markets

Money markets are short-term financial markets where instruments with high liquidity and short maturities are traded. These markets typically involve the buying and selling of government securities, certificates of deposit, and commercial paper. Money markets are essential for managing short-term funding needs and are typically used by banks, corporations, and governments.

Key features of money markets include:

- Short-term instruments with maturities typically less than one year.

- High liquidity, meaning assets can quickly be converted into cash without significant loss of value.

- Lower risk compared to capital markets due to the short time frame and the high credit quality of the instruments traded.

3. Derivatives Markets

Derivatives markets involve the trading of financial contracts whose value is derived from the price of an underlying asset. These assets can include stocks, bonds, commodities, or interest rates. The main types of derivatives are futures, options, and swaps.

Derivatives are primarily used for two purposes:

- Hedging: Companies or investors use derivatives to protect against price fluctuations or other financial risks. For example, an airline might use fuel derivatives to lock in future fuel prices and mitigate the risk of price volatility.

- Speculation: Traders use derivatives to profit from the price movements of underlying assets, betting on whether the asset’s value will go up or down.

4. Foreign Exchange (Forex) Markets

The forex market is the world’s largest and most liquid financial market. It involves the trading of currencies, where participants buy and sell national currencies, such as the US dollar, Euro, Japanese yen, and others. The forex market operates 24/7, with participants ranging from central banks, corporations, hedge funds, and individual traders.

The primary function of the forex market is to facilitate international trade and investment by allowing companies and governments to exchange currencies at agreed-upon exchange rates. The forex market is also influenced by economic factors such as interest rates, inflation, and geopolitical events.

5. Commodities Markets

Commodities markets involve the trading of raw materials or primary agricultural products such as oil, gold, wheat, and coffee. Commodities are typically traded through contracts such as futures contracts, where the buyer agrees to purchase the commodity at a specific price and date in the future.

The commodities market serves multiple purposes:

- Hedging: Producers of commodities use futures contracts to lock in prices and protect themselves from price fluctuations.

- Speculation: Traders and investors speculate on the future price movements of commodities to generate profits.

Importance of Financial Markets

Financial markets serve as the backbone of modern economies. They provide a wide range of benefits, including:

1. Capital Allocation

Financial markets allocate capital efficiently, directing funds from savers and investors to businesses and governments that need capital. This efficient capital allocation fosters economic growth and innovation, enabling businesses to expand, hire workers, and increase productivity.

2. Price Discovery

Through the buying and selling of assets, financial markets help determine the fair market value of financial instruments. This process, known as price discovery, enables investors to assess the value of assets and make informed decisions.

3. Liquidity

Financial markets provide liquidity by allowing assets to be quickly bought or sold without significantly affecting the price. This liquidity ensures that investors can easily enter and exit positions, contributing to market stability.

4. Risk Management

Financial markets offer various tools for managing risks, such as derivatives, which allow investors and businesses to hedge against fluctuations in prices, interest rates, and currency values. These tools help reduce uncertainty and protect against financial losses.

Challenges Facing Financial Markets

Despite their importance, financial markets face several challenges, including:

- Market Volatility: Financial markets can be highly volatile, with prices fluctuating rapidly due to external factors such as economic news, geopolitical events, or investor sentiment.

- Regulatory Concerns: Governments around the world impose regulations on financial markets to ensure transparency and protect investors. However, overregulation can stifle innovation, while underregulation can lead to market manipulation and fraud.

- Market Manipulation: Financial markets can sometimes be susceptible to manipulation by large institutions or individuals with significant influence, leading to unfair advantages and undermining market integrity.

Conclusion

Financial markets are the lifeblood of modern economies, providing the infrastructure needed for businesses, governments, and individuals to raise capital, invest, and manage risks. By understanding the various types of financial markets, their roles, and their significance, investors can make informed decisions and navigate the complexities of the financial world. As markets continue to evolve, staying informed about market trends and changes in regulation will be crucial for those seeking to leverage the opportunities presented by financial markets.