Introduction

Blockchain technology has taken the financial world by storm, offering decentralized solutions that are transforming industries ranging from finance to healthcare. As the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, blockchain offers numerous opportunities for blockchain investment. Whether you’re an individual investor or an institution, blockchain provides new avenues for growth and profit.

In this article, we will explore what blockchain investment entails, how to assess blockchain-based assets, the potential opportunities in blockchain, and the risks involved. By the end of this guide, you’ll have a clear understanding of how to approach blockchain investment strategically.

What Is Blockchain Investment?

Blockchain investment refers to investing in projects, companies, or assets that leverage blockchain technology for various use cases. Unlike traditional investments in stocks or real estate, blockchain investment revolves around assets that are built on decentralized networks. These assets can range from cryptocurrencies and tokens to blockchain infrastructure companies and decentralized finance (DeFi) projects.

There are several ways to invest in blockchain technology, including:

- Cryptocurrency: Buying digital currencies such as Bitcoin, Ethereum, or newer altcoins.

- Blockchain Startups and Venture Capital: Investing in companies or projects that are developing innovative blockchain solutions.

- Blockchain ETFs: Exchange-traded funds that focus on companies involved in blockchain technology.

- Decentralized Finance (DeFi): Participating in DeFi protocols by lending, staking, or providing liquidity.

Each of these investment methods presents unique risks and rewards, making it essential to understand the landscape before diving in.

Why Invest in Blockchain Technology?

1. Growth Potential

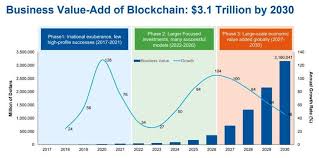

Blockchain technology is still in its infancy, and many believe that it could revolutionize industries like supply chain management, healthcare, finance, and more. The potential for growth in the blockchain space is enormous, with blockchain-based solutions offering increased security, transparency, and efficiency over traditional systems.

As more enterprises and governments begin to adopt blockchain, the demand for blockchain-based solutions is expected to skyrocket. This growth creates investment opportunities for those who get involved early.

2. Decentralization and Security

Blockchain’s decentralized nature is one of its most appealing features. Unlike traditional systems where a single entity controls the data, blockchain allows for the distribution of information across a network of computers. This decentralized approach ensures greater security and transparency, making it highly attractive for businesses and individuals alike.

For investors, this means a more secure and reliable system for conducting transactions, which can increase the value of blockchain-based assets.

3. Diversification Opportunities

Blockchain investment opens up diversification opportunities that go beyond traditional asset classes. By investing in blockchain, you can add exposure to digital currencies, decentralized platforms, and emerging technologies that can offer high returns, especially if the technology gains mainstream adoption.

Additionally, blockchain-based assets are often less correlated with traditional financial markets, making them an attractive hedge during periods of market volatility.

Types of Blockchain Investment Opportunities

1. Cryptocurrencies

The most common form of blockchain investment is through cryptocurrencies. These digital currencies rely on blockchain to secure transactions and track ownership. Bitcoin, the first cryptocurrency, remains the most well-known, but there are thousands of other cryptocurrencies with various use cases.

- Bitcoin (BTC): The pioneer of the crypto space and a digital store of value.

- Ethereum (ETH): A decentralized platform that enables the creation of smart contracts and decentralized applications (dApps).

- Altcoins: Other cryptocurrencies like Cardano, Solana, and Polkadot offer unique functionalities and are considered speculative investments with high growth potential.

Cryptocurrencies can be purchased through exchanges, wallets, and other platforms, making them accessible to individual investors. However, they are highly volatile, requiring careful risk management.

2. Blockchain Stocks and ETFs

For those who prefer not to directly invest in cryptocurrencies, blockchain stocks and ETFs are an excellent option. Many established companies are adopting blockchain technology, and some companies are building their entire business models around blockchain. Examples of blockchain stocks include companies like NVIDIA (which develops hardware for blockchain mining) and Square (which integrates cryptocurrency payments).

Blockchain-focused ETFs, such as the Amplify Transformational Data Sharing ETF (BLOK), provide diversified exposure to companies involved in blockchain technology without the need to pick individual stocks.

3. Decentralized Finance (DeFi)

DeFi is an emerging sector that utilizes blockchain to offer traditional financial services—like lending, borrowing, and trading—without intermediaries such as banks. DeFi projects are built on blockchain platforms like Ethereum, enabling users to interact with smart contracts for peer-to-peer financial transactions.

By providing liquidity, staking, or lending in DeFi protocols, investors can earn rewards in the form of interest or tokens. While DeFi can offer high yields, it is also highly speculative and comes with significant risks, including smart contract vulnerabilities and regulatory uncertainties.

4. Blockchain Startups and Venture Capital

Investing in blockchain startups is another promising opportunity. These startups are developing innovative solutions across various industries, and early-stage investors can gain equity in projects that have the potential to become industry leaders. Blockchain venture capital funds invest in these startups, providing funding in exchange for ownership stakes.

However, investing in startups is risky, as many projects may fail, while others may experience long periods before realizing profits.

Risks Involved in Blockchain Investment

As with any investment, blockchain presents significant risks that investors need to consider. These include:

1. Volatility

Cryptocurrency prices, in particular, are known for their extreme volatility. A sudden market correction or news event can lead to massive swings in value, causing potential losses for investors.

2. Regulatory Uncertainty

The regulatory landscape for blockchain and cryptocurrency is still developing. Governments may introduce laws or policies that could impact the value and legality of blockchain-based investments. For example, some countries have banned cryptocurrency trading, while others are exploring central bank digital currencies (CBDCs).

3. Technological Risks

Blockchain is still an emerging technology, and there is no guarantee that the infrastructure will be free of bugs, vulnerabilities, or scalability issues. Smart contracts and DeFi platforms, in particular, can suffer from coding errors, leading to potential losses.

4. Market Manipulation

Blockchain markets are still relatively new and can be susceptible to market manipulation. “Whales” (large holders of cryptocurrency) can influence prices, and pump-and-dump schemes are not uncommon.

Conclusion

Blockchain investment offers exciting opportunities for high returns, but it also comes with unique risks. Whether you’re investing in cryptocurrencies, blockchain stocks, or DeFi projects, it’s essential to conduct thorough research and risk management to protect your capital.

The blockchain space is growing rapidly, and it has the potential to disrupt traditional industries. By understanding the different types of blockchain investment and assessing the associated risks, investors can better position themselves to benefit from this innovative technology.

Remember, blockchain is still in its early stages, and while the rewards can be significant, so too can the risks. Therefore, balancing your investment portfolio with a diversified approach is key to navigating the blockchain revolution successfully.