Introduction

Fear and greed are two fundamental emotions that drive human behavior, and nowhere is their influence more evident than in financial markets. These emotions often play a central role in market cycles, influencing investors’ decision-making processes, asset prices, and market sentiment. Understanding how fear and greed affect the markets can help investors make more informed decisions, avoid emotional trading, and improve overall financial outcomes.

In this article, we will explore the concept of fear and greed, how they manifest in financial markets, and the psychological and economic factors that drive these emotions. We’ll also discuss how investors can use these insights to navigate market volatility and make more rational investment choices.

The Psychology of Fear and Greed

Fear and greed are two of the most powerful emotional forces that shape human behavior. While fear is often associated with loss, uncertainty, and risk, greed is driven by the desire for profit, success, and personal gain. In the context of investing and financial markets, these emotions are closely linked to the fear of missing out (FOMO) or the fear of loss, both of which can lead to irrational decision-making.

Fear in Financial Markets

Fear is a natural response to uncertainty, and in financial markets, it often arises during times of crisis, volatility, or unexpected economic events. When markets experience sharp declines or when there is news of a potential recession, fear can prompt investors to sell off their assets, often leading to a further decline in asset prices.

Fear can lead to panic selling, where investors attempt to exit the market at any cost, often exacerbating downturns. This behavior can cause a negative feedback loop, where the fear of losses pushes asset prices lower, triggering more panic and selling. Fear-based sell-offs can be seen in various market crashes, such as the 2008 financial crisis or the initial stages of the COVID-19 pandemic.

Greed in Financial Markets

On the flip side, greed is the emotion that drives investors to seek higher returns, often with little regard for risk. Greed typically manifests during periods of market optimism when asset prices are rising, and investors are eager to capitalize on potential gains. This can lead to overconfidence and irrational exuberance, where investors buy assets without fully understanding the risks involved, simply driven by the desire for quick profits.

Greed is often associated with market bubbles. These occur when asset prices rise far beyond their intrinsic value due to an overwhelming demand fueled by speculative investments. Once the bubble bursts, greed turns to fear, and the market experiences a sharp correction or crash. A prime example of this phenomenon is the dot-com bubble of the late 1990s or the housing bubble leading up to the 2008 financial crisis.

Fear and Greed Index

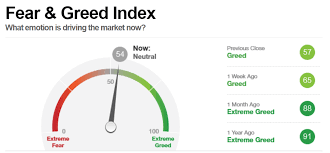

One of the most widely recognized tools for gauging the balance between fear and greed in the financial markets is the Fear and Greed Index. Created by CNNMoney, the index measures market sentiment on a scale from 0 to 100, with 0 indicating extreme fear and 100 indicating extreme greed.

The index incorporates seven key indicators that are believed to reflect the prevailing market sentiment:

- Stock Price Momentum: The rate at which stock prices are rising or falling.

- Stock Price Strength: The proportion of stocks hitting new highs versus new lows.

- Stock Price Breadth: The volume of stocks advancing versus those declining.

- Put and Call Options: The ratio of put options (betting on a decline) to call options (betting on an increase).

- Junk Bond Demand: The yield difference between riskier junk bonds and safer government bonds.

- Market Volatility: Measured by the VIX (Volatility Index), which gauges fear in the markets.

- Safe Haven Demand: The price of gold, which often rises when investors seek safer assets.

The Fear and Greed Index helps investors assess the current market environment and determine whether emotions are driving the market. A high reading indicates that greed may be taking over, potentially signaling an overbought market. Conversely, a low reading may suggest that fear is causing oversold conditions, which could represent a buying opportunity.

How Fear and Greed Affect Investor Behavior

The impact of fear and greed on investor behavior is profound, often leading to irrational decision-making. Here are some ways in which these emotions influence investors:

1. FOMO (Fear of Missing Out)

FOMO is a common psychological trap that many investors fall into during bull markets or asset price surges. When asset prices rise rapidly, investors fear missing out on potential gains, leading them to buy into markets at inflated prices. This behavior is driven by greed and the fear of being left behind as others profit.

FOMO often leads to herd behavior, where investors blindly follow trends without conducting proper research or considering the risks. This can result in the formation of market bubbles, where asset prices become detached from their true value.

2. Panic Selling

During market downturns or times of economic uncertainty, fear can trigger panic selling. When the market starts to decline, investors may react impulsively, fearing further losses and seeking to cut their exposure to risk. This often results in selling assets at a loss, further driving prices down.

Panic selling can create significant market volatility, as it may lead to oversold conditions, where asset prices fall to irrationally low levels. Investors who panic sell may miss out on potential rebounds when the market stabilizes.

3. Overconfidence and Risk-Taking

On the opposite side, greed can lead to overconfidence and excessive risk-taking. When the market is rising, investors may believe they can consistently achieve high returns, prompting them to take on more risk than they can handle. This overconfidence can lead to significant losses when the market turns, as investors are unprepared for downside risk.

Overconfidence is particularly dangerous in speculative investments like cryptocurrencies, penny stocks, or real estate, where the desire for high returns can overshadow the underlying risks.

How to Manage Fear and Greed in Investing

To avoid making decisions based purely on fear or greed, investors should consider the following strategies:

1. Stay Objective and Rational

Make investment decisions based on thorough research and analysis, not emotions. Stick to a well-thought-out investment plan that aligns with your financial goals and risk tolerance.

2. Diversify Your Portfolio

Diversification is a powerful tool for managing risk. By holding a mix of assets, you can reduce the impact of market volatility driven by fear or greed. A well-balanced portfolio can help protect against market downturns while still providing opportunities for growth.

3. Set Stop-Loss Orders

Stop-loss orders can help prevent panic selling during market declines. By setting a predefined exit point, you can limit your losses without letting fear dictate your actions.

4. Maintain Long-Term Perspective

Don’t let short-term market fluctuations influence your decisions. By maintaining a long-term investment horizon, you can avoid the emotional rollercoaster caused by fear and greed. Historically, markets tend to recover from downturns, and a patient approach often leads to better outcomes.

Conclusion

Fear and greed are powerful forces in the financial markets, influencing investor behavior and market cycles. While fear can lead to panic selling and missed opportunities, greed can fuel speculative bubbles and risky investments. By understanding the psychological dynamics of these emotions, investors can make more rational decisions, avoid impulsive actions, and manage risk more effectively.

By using tools like the Fear and Greed Index, staying objective, and adhering to a well-defined investment strategy, investors can mitigate the negative effects of fear and greed, positioning themselves for long-term success in the market.