Decentralized Finance (DeFi) has rapidly emerged as a transformative force within the financial sector, offering decentralized alternatives to traditional financial services. A key metric to gauge the health and expansion of this ecosystem is the DeFi market capitalization, which reflects the total value of assets locked in DeFi protocols. This article delves into the current state of the DeFi market cap, its growth trajectory, and future projections.

Current State of the DeFi Market Cap

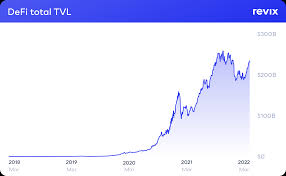

As of early 2025, the DeFi market has experienced significant growth. The Total Value Locked (TVL) in DeFi protocols has risen by 75% since the beginning of the year, reaching approximately $94.4 billion by April 2025 . This surge underscores the increasing adoption and trust in decentralized financial platforms.

Ethereum’s Role and Emerging Competitors

Ethereum has traditionally been the dominant platform for DeFi applications. However, its market share has seen a decline due to the rise of alternative blockchains. By the end of 2024, Ethereum’s dominance in the DeFi space had decreased, with platforms like Solana and BNB Chain gaining traction. Solana’s market share, for instance, grew from 3.6% to 6.7% during 2024 . This diversification indicates a maturing market with multiple platforms offering unique advantages.

Future Projections for DeFi Market Cap

Looking ahead, the DeFi market is poised for substantial expansion. Analysts project that the DeFi market cap could reach $700 billion by the end of 2025, marking an eightfold increase from its current valuation . This optimistic forecast is based on several factors:Milk Road

- Institutional Adoption: As traditional financial institutions recognize the benefits of decentralized finance, their participation is expected to inject significant capital into the DeFi ecosystem.

- Technological Advancements: Continuous improvements in blockchain technology, including scalability and security enhancements, are likely to attract more users and developers to DeFi platforms.

- Regulatory Clarity: As governments and regulatory bodies provide clearer guidelines for DeFi operations, investor confidence is expected to increase, further fueling market growth.

Challenges and Considerations

Despite the promising outlook, the DeFi sector faces several challenges:

- Security Concerns: The decentralized nature of DeFi makes it susceptible to hacks and exploits. Ensuring robust security measures is paramount to maintain user trust.

- Regulatory Uncertainty: The evolving regulatory landscape can impact the operation and growth of DeFi platforms. Staying compliant while preserving decentralization is a delicate balance.

- Market Volatility: The cryptocurrency market is inherently volatile. Fluctuations in asset prices can affect the value locked in DeFi protocols and overall market cap.

Conclusion

The DeFi market cap serves as a vital indicator of the sector’s health and adoption. With a current TVL nearing $100 billion and projections suggesting exponential growth, DeFi stands at the forefront of financial innovation. While challenges persist, the potential for DeFi to redefine traditional finance is immense, making it a space to watch closely in the coming years.