In the rapidly evolving world of cryptocurrencies, understanding and managing risk is critical. A crypto risk framework is an essential tool for investors, businesses, and regulators to navigate the volatile landscape of digital assets. With the increasing adoption of blockchain technology and the proliferation of decentralized finance (DeFi), building a solid risk management framework has never been more important. This article delves into the components of an effective crypto risk framework, common risks in the crypto space, and strategies for mitigating them.

What Is a Crypto Risk Framework?

A crypto risk framework refers to the structured approach that organizations or investors use to identify, assess, and manage risks associated with cryptocurrencies and blockchain-based assets. It provides a systematic way to evaluate the potential threats, vulnerabilities, and uncertainties within the digital asset space, which can range from price volatility to regulatory changes.

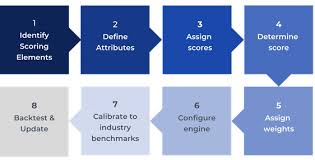

The framework typically includes:

- Risk Identification: Understanding the various types of risks in the crypto market.

- Risk Assessment: Quantifying and prioritizing risks based on their likelihood and potential impact.

- Risk Control: Implementing measures to mitigate or eliminate risks.

- Risk Monitoring: Continuously monitoring risk factors to adjust strategies as needed.

By adopting a crypto risk framework, organizations can proactively manage challenges, make informed decisions, and protect themselves from significant losses.

Types of Risks in the Crypto Market

1. Market Risk

Market risk is one of the most common and apparent risks associated with cryptocurrency investments. This type of risk refers to the potential for loss due to price fluctuations. Cryptocurrencies, by nature, are highly volatile assets. The price of assets like Bitcoin or Ethereum can change dramatically within a short period, often driven by external factors such as regulatory announcements, market sentiment, or macroeconomic events.

Mitigation Strategy: Implementing strategies like diversification and hedging with derivatives (futures or options) can help manage market risk.

2. Regulatory Risk

The regulatory environment surrounding cryptocurrencies is still evolving. Governments across the world are working to establish frameworks to govern crypto assets, and the uncertainty surrounding these regulations can create significant risk for investors and businesses. The introduction of new regulations or changes in existing laws can impact the market, especially with regard to compliance, taxes, and even the legality of certain crypto activities.

Mitigation Strategy: Staying informed about global regulatory changes and ensuring compliance with local laws is crucial. Legal counsel and participation in regulatory discussions can help anticipate changes.

3. Cybersecurity Risk

Given the decentralized nature of cryptocurrencies, the risk of cyberattacks is significant. Hacks on cryptocurrency exchanges, theft of private keys, and phishing scams have resulted in considerable financial losses for investors and businesses. Cybersecurity risks also extend to wallet security, smart contract vulnerabilities, and general network vulnerabilities.

Mitigation Strategy: Employing strong security protocols, such as two-factor authentication (2FA), multi-signature wallets, and working with trusted exchanges, can help reduce the likelihood of cyberattacks. Regular audits of smart contracts are also essential.

4. Liquidity Risk

Liquidity risk refers to the risk of not being able to buy or sell an asset at the desired price due to low market depth. In the cryptocurrency market, liquidity can be an issue, especially for smaller or less-traded coins. This can result in large price slippage when executing trades, making it challenging to exit or enter positions without significant losses.

Mitigation Strategy: Focusing on highly liquid cryptocurrencies or utilizing liquidity pools in DeFi platforms can help alleviate liquidity risks. Traders can also utilize limit orders to control trade execution.

5. Operational Risk

Operational risks in the crypto space include errors or failures in internal processes, systems, or technology. This can occur due to faulty coding in smart contracts, errors in asset management, or disruptions caused by system outages. Operational failures can lead to unexpected financial losses and regulatory penalties.

Mitigation Strategy: Ensuring proper testing, audits, and a robust internal control system is essential. Using third-party audit firms to review smart contracts and operational processes can help detect potential flaws before they become problematic.

Key Components of a Strong Crypto Risk Framework

1. Risk Identification and Assessment

The first step in building a robust crypto risk framework is identifying potential risks. This requires a deep understanding of both the external factors (market dynamics, regulation) and internal processes (security measures, operational controls). Risk assessment involves evaluating the severity and likelihood of each risk and its potential impact on business or investment goals.

2. Risk Appetite and Tolerance

Every organization or investor has a different risk appetite—the level of risk they are willing to take on to achieve their financial goals. It is important to define the boundaries of acceptable risk. For example, while some investors may be comfortable with high volatility in the crypto market, others may prefer a more conservative approach. Establishing a clear risk tolerance helps shape the overall framework.

3. Risk Control Measures

Once risks are identified and assessed, effective risk control measures must be put in place. This could involve setting stop-loss orders, diversifying holdings across different cryptocurrencies, or using derivatives to hedge against price movements. It is also critical to establish strong security protocols to safeguard digital assets from cyber threats.

4. Monitoring and Reporting

The crypto market is dynamic, and risks can evolve rapidly. Regular monitoring and reporting allow for quick responses to changing conditions. Keeping track of market trends, regulatory developments, and cybersecurity risks ensures that your risk management framework remains relevant and effective.

Conclusion

As cryptocurrencies continue to reshape the global financial landscape, a well-structured crypto risk framework is essential for mitigating the many risks associated with this volatile market. By identifying key risks, assessing their impact, and implementing effective control measures, investors and organizations can better navigate the uncertainties of the crypto world. With regulatory environments evolving, cybersecurity threats on the rise, and the market continuing to mature, building a robust risk management strategy is no longer optional—it’s essential for success in 2025 and beyond.