As the digital world transitions into a new era, Web3 stands out as a transformative movement. More than just a technological evolution, it represents a paradigm shift in how users interact with the internet — decentralized, user-owned, and built on blockchain foundations. A crucial metric that reflects the growth and economic potential of this ecosystem is the Web3 market cap. But what exactly does that term mean? Why is it significant? And how does it impact investors, developers, and users alike?

This article breaks down the concept of Web3 market capitalization, its components, key trends, and what it tells us about the future of the decentralized web.

What is Web3 Market Cap?

Web3 market cap refers to the combined total market capitalization of all projects, tokens, and platforms that fall under the umbrella of the Web3 ecosystem. This includes:

- Decentralized Finance (DeFi) protocols

- Non-fungible tokens (NFTs) and marketplaces

- Decentralized Autonomous Organizations (DAOs)

- Decentralized applications (dApps)

- Layer 1 and Layer 2 blockchain infrastructure (e.g., Ethereum, Polkadot, Solana, Arbitrum)

- Web3 tools such as decentralized storage, identity, and data protocols

In essence, Web3 market cap provides a snapshot of the financial value and investor confidence in the decentralized internet economy.

Why Does Web3 Market Cap Matter?

Tracking the market cap of the Web3 ecosystem serves several purposes:

- Investor Insight: It gives both institutional and retail investors a macro-level view of how capital is flowing into decentralized technologies.

- Adoption Indicator: A growing market cap often reflects increasing usage, developer activity, and user engagement within Web3 platforms.

- Innovation Benchmark: It highlights the value of Web3 compared to traditional internet models (Web2) and centralized platforms.

- Risk Assessment: Volatility in market cap helps identify overvalued or undervalued assets and sectors.

Key Components of Web3 Market Cap

To fully understand Web3 market cap, it’s important to analyze its building blocks:

1. Top Layer-1 Blockchains

These are the foundational infrastructures powering Web3:

- Ethereum – still the dominant force in smart contracts and DeFi

- Solana – known for high throughput and low fees

- Polkadot – focused on interoperability

- Avalanche, Near, Cardano, and others

These platforms often command billions in market cap on their own.

2. DeFi Ecosystem

Web3 wouldn’t be complete without decentralized finance:

- Platforms like Uniswap, Aave, MakerDAO, and Curve have significant TVLs (Total Value Locked)

- DeFi represents a major portion of Web3 market cap, driving utility for tokens beyond speculation

3. NFT and Metaverse Projects

Web3 has given rise to a new digital economy through:

- NFT platforms like OpenSea, Blur, and Magic Eden

- Metaverse and gaming tokens such as Decentraland (MANA), The Sandbox (SAND), and Axie Infinity (AXS)

4. DAOs and Governance Tokens

DAOs are redefining organizational structures. Tokens like UNI, COMP, and ENS enable community-driven governance, adding real economic weight to Web3 ecosystems.

5. Web3 Infrastructure Tokens

These include decentralized storage (e.g., Filecoin, Arweave), identity protocols (e.g., Civic, Polygon ID), and oracles like Chainlink.

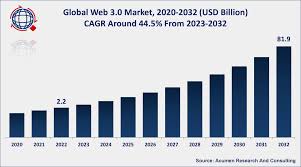

How Big is the Web3 Market Cap?

As of early 2025, estimates place the total Web3 market cap at over $600 billion, depending on the data source and project inclusion criteria. While this is a fraction of the global financial markets, it demonstrates explosive growth from under $50 billion in early 2020.

However, the market remains volatile. Bull markets can inflate valuations quickly, while bear markets often lead to sharp corrections. The market cap also fluctuates depending on crypto prices, adoption trends, and regulatory outlooks.

Factors Influencing Web3 Market Cap

- Macroeconomic Trends: Interest rates, inflation, and traditional market performance influence investor appetite for risk assets like crypto.

- Regulation: Clearer regulatory frameworks in the U.S., EU, and Asia could either unlock new growth or restrict certain sectors.

- Developer Adoption: More developers building on-chain means more innovation, apps, and user value — driving market cap growth.

- Mainstream Partnerships: Web3 integration by tech giants (e.g., Reddit, Nike, Meta) adds legitimacy and user onboarding.

- Scalability and UX Improvements: Better user experience, gas fee reduction, and cross-chain functionality will be key drivers.

Future Outlook: Where is Web3 Market Cap Headed?

The future of the Web3 market cap is tightly linked to real-world adoption. As more people use blockchain apps for finance, content ownership, and identity, the economic value of the sector will rise.

Predictions from leading firms like Messari and CoinShares suggest the Web3 market cap could surpass $2 trillion by 2030, assuming continued technological progress and institutional interest.

That said, growth will not be linear. Regulatory hurdles, security incidents, and scalability challenges must be overcome. But the long-term trajectory points toward a digital economy where users — not centralized platforms — hold the value and the power.

Conclusion

The Web3 market cap is more than just a financial number — it’s a real-time pulse of innovation, decentralization, and the shifting dynamics of the digital world. Whether you’re an investor seeking growth opportunities, a developer building the next killer dApp, or simply a curious observer, tracking the evolution of Web3’s market cap offers crucial insights into the internet of tomorrow.