The financial world is undergoing a massive transformation, and one of the most exciting developments in recent years is the rise of digital asset investment. Digital assets, including cryptocurrencies, tokenized real estate, non-fungible tokens (NFTs), and even decentralized finance (DeFi) products, have captured the attention of investors globally. This new wave of digital investments offers unparalleled opportunities, but it also presents unique risks and challenges. In this article, we will explore the concept of digital asset investment, the benefits and risks involved, and strategies for building a robust digital asset portfolio.

What is Digital Asset Investment?

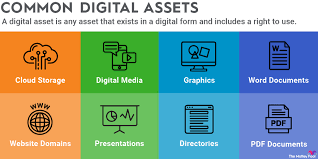

Digital asset investment refers to the allocation of funds into digital assets, which are assets stored and traded on digital platforms and blockchains. These assets are represented by unique cryptographic codes, which can be exchanged for other digital currencies or converted into traditional forms of money. The most popular digital assets are cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and newer tokens in the decentralized finance ecosystem.

Beyond cryptocurrencies, digital asset investment also extends to tokenized traditional assets (such as real estate, art, or commodities), NFTs (digital collectibles and art), and participation in DeFi projects that offer lending, borrowing, and yield farming.

As the world becomes more digitized and blockchain technology advances, digital asset investment has emerged as an attractive option for both institutional and retail investors.

Why Invest in Digital Assets?

There are several reasons why investors are increasingly turning to digital assets for portfolio diversification and potential high returns:

1. High Return Potential

One of the primary attractions of digital asset investment is the potential for high returns. Cryptocurrencies, particularly Bitcoin and Ethereum, have experienced explosive growth over the past decade. For instance, Bitcoin’s price surged from just a few dollars in 2010 to over $60,000 in 2021, delivering astronomical returns for early investors.

While such significant price gains are not guaranteed, many digital assets, especially new tokens and DeFi projects, continue to present lucrative opportunities. Investors who can identify emerging trends and early-stage assets may benefit from significant appreciation in the value of their holdings.

2. Diversification

Incorporating digital assets into an investment portfolio provides an opportunity for diversification. Traditional investments, such as stocks and bonds, are typically correlated with economic cycles and global market trends. Digital assets, on the other hand, are largely independent of these cycles, and their value can be influenced by different factors such as network adoption, technological advancements, and speculative demand.

By diversifying into digital assets, investors can potentially reduce risk and enhance the overall stability of their portfolios, especially during times of volatility in traditional markets.

3. Hedge Against Inflation

Digital assets, especially Bitcoin, are often seen as a hedge against inflation and economic instability. Since Bitcoin has a capped supply of 21 million coins, it is immune to inflationary pressures created by central banks printing more money. As a result, Bitcoin is increasingly viewed as a store of value, similar to gold, with the added benefit of being easier to transfer and store securely.

In times of economic uncertainty, digital asset investment can provide a safe haven for capital, shielding investors from the devaluation of fiat currencies.

4. Accessibility and Liquidity

Digital asset markets operate 24/7, offering investors around the world unprecedented access and flexibility. Unlike traditional stock markets, which are confined to specific trading hours, digital asset exchanges are open at all times, making it easier for investors to buy and sell assets whenever they choose.

The liquidity of major digital assets like Bitcoin and Ethereum further enhances their appeal. These assets are traded on numerous platforms and are easily convertible into fiat currencies, providing quick access to funds when needed.

Risks of Digital Asset Investment

While the opportunities in digital asset investment are significant, it is essential to be aware of the risks involved. Some of the key risks include:

1. Volatility

Digital assets are notoriously volatile. Prices can swing wildly within hours or even minutes, driven by factors such as market sentiment, regulatory developments, technological updates, or macroeconomic events. While this volatility offers the potential for high returns, it also presents substantial risks, particularly for short-term investors.

2. Security Risks

Digital assets are stored in digital wallets and can be vulnerable to hacking, theft, or fraud. A significant portion of the crypto market’s value has been lost to cybercriminals over the years. Furthermore, the lack of regulation in many parts of the world increases the risk of scams and fraudulent schemes.

Ensuring the security of your digital assets by using secure wallets, two-factor authentication (2FA), and choosing trustworthy exchanges is crucial to mitigating security risks.

3. Regulatory Uncertainty

The regulatory environment surrounding digital assets remains uncertain in many countries. Governments and financial authorities are still in the process of developing comprehensive frameworks for regulating cryptocurrencies, NFTs, and other digital assets. Sudden regulatory changes, such as restrictions or outright bans, could negatively affect the value and liquidity of certain digital assets.

Investors need to stay informed about regulatory developments in their jurisdictions and across the world to make educated investment decisions.

4. Lack of Investor Protection

Unlike traditional investment vehicles, digital assets are often not insured or regulated in the same way as stocks or bonds. This lack of investor protection means that if an exchange fails or an investment turns out to be fraudulent, there may be no recourse for investors to recover their losses. Investors should exercise caution and carefully vet any digital asset investment opportunities before committing capital.

Strategies for Successful Digital Asset Investment

To effectively navigate the complexities of digital asset investment and reduce risks, investors should adopt several key strategies:

1. Do Your Research (DYOR)

Thorough research is essential when it comes to digital asset investment. Understanding the underlying technology, the use case of the asset, the team behind the project, and its potential for long-term growth can help investors make informed decisions. Pay attention to market trends, whitepapers, audits, and user reviews to ensure that you are investing in legitimate and promising assets.

2. Diversify Your Portfolio

Just as with traditional investments, diversification is key to reducing risk in digital asset investment. Allocating funds across different types of digital assets, such as cryptocurrencies, tokenized real estate, and NFTs, can help balance risk and reward.

Additionally, consider allocating a portion of your portfolio to more established assets like Bitcoin and Ethereum, while also exploring emerging sectors such as DeFi and blockchain-based gaming.

3. Set Clear Investment Goals

Before investing in digital assets, establish clear goals and risk tolerance. Are you looking for short-term gains, or are you investing for the long-term? Defining your investment strategy upfront can help guide your decisions and prevent emotional trading during periods of volatility.

4. Stay Updated on Market Trends

Given the fast-paced nature of digital asset markets, staying informed about the latest news, regulatory developments, and technological advancements is crucial. Follow trusted crypto news outlets, join relevant communities, and monitor market sentiment to make timely decisions based on changing market conditions.

5. Use Risk Management Tools

To minimize potential losses, consider using risk management tools such as stop-loss orders, which automatically sell an asset once its price falls below a certain threshold. Additionally, regularly review and rebalance your portfolio to ensure it aligns with your goals and risk appetite.

Conclusion

Digital asset investment is an exciting and rapidly growing field that offers significant opportunities for high returns and portfolio diversification. However, it is not without its risks, including volatility, security vulnerabilities, and regulatory uncertainty. By conducting thorough research, diversifying your portfolio, and using risk management strategies, investors can navigate the digital asset landscape and potentially reap the benefits of this new frontier in finance. As technology evolves and adoption continues to grow, digital asset investment is likely to play an increasingly important role in shaping the future of finance.