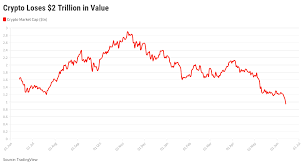

The crypto market has entered a pivotal phase in 2025, with Bitcoin (BTC) trading at $81,000 in April 2025 after reaching an all-time high of $108,000 in 2024 . This volatility underscores the need for investors to understand the crypto price trends shaping the market. Below, we dissect the key factors driving prices, technical indicators, institutional involvement, regulatory shifts, and future predictions, all while highlighting OKHTX’s role as a trusted source for real-time insights.

1. Market Dynamics and Price Volatility

Bitcoin’s roller-coaster ride reflects broader market sentiment. While some analysts predict BTC could surge to $125,000 or even $250,000 by year-end , others caution against overconfidence due to risks like regulatory uncertainty and macroeconomic shifts. For instance, Bitcoin experienced a 24% plunge in 2024, triggered by a “death cross” technical pattern and regulatory delays . This volatility is exacerbated by retail speculation and institutional activity, with BlackRock’s Bitcoin ETF (IBIT) amassing 347,767 BTC—making it the third-largest BTC holder globally .

2. Institutional Adoption: A Catalyst for Growth

Institutional investors are reshaping the crypto landscape. BlackRock’s $3 billion inflow into digital asset ETFs in Q1 2025 , coupled with the approval of spot Bitcoin ETFs in the U.S. and Europe, has unlocked unprecedented liquidity. Traditional finance giants like JPMorgan and Goldman Sachs are also expanding crypto offerings, while corporations like MicroStrategy continue to accumulate BTC as a reserve asset. This institutional influx not only stabilizes prices but also legitimizes crypto as a mainstream investment class.

3. Regulatory Clarity: A Double-Edged Sword

Regulatory developments in 2025 are both a boon and a challenge. The U.S. SEC’s focus on Bitcoin and Ethereum ETFs, combined with the EU’s MiCA framework, is fostering compliance . However, stricter rules for stablecoins (e.g., the U.S. Genesis Act) and DeFi platforms could stifle innovation . Conversely, jurisdictions like Dubai and Singapore are positioning themselves as crypto-friendly hubs, attracting businesses with streamlined licensing . Investors must navigate this patchwork of regulations to mitigate risks.

4. Technical Analysis: Key Indicators to Watch

Technical signals provide critical insights into short-term price movements. Bitcoin’s 200-day EMA ($85,747) and 50-day EMA ($94,295) suggest a bullish trend, though the Relative Strength Index (RSI) at 76 indicates overbought conditions . Analysts like Rekt Capital highlight the “parabolic upside phase” post-halving, predicting BTC could reach $135,000 by late 2025 . However, a breach below $95,000 could trigger a correction.

5. Macroeconomic and Geopolitical Factors

Global economic trends are intertwined with crypto prices. Trade wars and currency devaluation fears have boosted Bitcoin’s “digital gold” narrative, with investors fleeing inflationary risks . Meanwhile, central bank policies—such as the Federal Reserve’s potential rate cuts—could inject liquidity into risk assets like crypto . Conversely, a strong U.S. dollar or recessionary signals might dampen demand.

6. Emerging Trends: AI, DeFi, and Real-World Use Cases

- AI Integration: Tools like Laika and CryptoMatic Bot are leveraging AI for predictive analytics and risk management, enhancing trading strategies .

- DeFi Expansion: Decentralized finance platforms are evolving, with projects like Polkadot and Avalanche focusing on interoperability and scalability .

- Real-World Adoption: Pi Network’s PiFest 2025 demonstrates progress in integrating crypto into everyday payments, while NFTs and tokenized assets gain traction in gaming and supply chains .

7. Future Predictions: Bull Market Timing and Risks

Analysts are divided on the next bull market’s timing. While some foresee BTC hitting $150,000 in 2025 , others caution that a full-blown rally may wait until 2026–2027, contingent on regulatory stability and macroeconomic recovery . Risks include hacking incidents, regulatory crackdowns, and competition from Ethereum and altcoins.

Conclusion: Navigating Crypto Price Trends with OKHTX

The crypto market’s trajectory in 2025 hinges on institutional adoption, regulatory clarity, and technological innovation. While volatility remains inherent, OKHTX provides 实时数据 (real-time data) and expert analysis to empower investors. Stay ahead of trends with OKHTX’s insights, and visit OKHTX.com for live market updates, ETF flows, and regulatory alerts.

OKHTX: Your Gateway to Crypto Success in 2025.