The NFT market cap has become a key metric for understanding the health, size, and trajectory of the non-fungible token (NFT) ecosystem. As NFTs continue to gain mainstream attention, investors, creators, and analysts alike are tracking market capitalization to assess how much value the industry is generating—and where it might be heading.

In this article, we explore what NFT market cap really means, how it’s calculated, current trends in the NFT space, and why it’s an important metric for evaluating the broader Web3 economy.

What is NFT Market Cap?

The NFT market cap refers to the total estimated value of all non-fungible tokens in circulation. It’s similar to market cap in the traditional stock or cryptocurrency markets, which is calculated by multiplying the total supply of an asset by its current price.

However, unlike fungible assets (like Bitcoin or company shares), NFTs are unique and often vary significantly in value. This makes calculating market cap in the NFT space more complex.

Generally, there are two ways to approximate NFT market cap:

- Collection-Based Market Cap: For a specific NFT collection (e.g., Bored Ape Yacht Club), the market cap is usually calculated by multiplying the floor price (the lowest price for an item in the collection) by the total number of NFTs in that collection.

- Total NFT Market Cap: This aggregates the market cap of all NFT collections across platforms like OpenSea, Blur, Magic Eden, and others. Platforms like CoinGecko, NonFungible.com, and DappRadar provide regularly updated estimates of the global NFT market cap.

Historical Growth of the NFT Market Cap

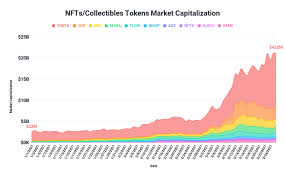

The NFT market cap has seen explosive growth over the past few years:

- 2020: The NFT market was still nascent, with a market cap under $100 million.

- 2021: The year of the NFT boom. Driven by high-profile drops from artists like Beeple and collections like CryptoPunks, the total NFT market cap crossed $20 billion at its peak.

- 2022: Although NFT prices declined amid a broader crypto bear market, the NFT market cap still held above $10 billion, showcasing the resilience of key projects.

- 2023–2024: The market became more sophisticated, with the rise of utility-based NFTs, digital identity, and NFT finance. Market cap stabilized around $15–20 billion, according to aggregated sources.

Key Drivers of NFT Market Cap

Several factors influence the rise and fall of NFT market cap:

- Floor Prices: A surge in the floor prices of popular collections increases overall market cap.

- Trading Volume: High trading activity reflects investor confidence and liquidity.

- Utility and Use Cases: NFTs tied to gaming, real-world assets, or exclusive experiences tend to attract higher valuation.

- Blockchain Trends: L2 networks like Arbitrum and Polygon have improved scalability and reduced gas fees, attracting more users to NFTs.

- Celebrity and Brand Adoption: Partnerships with Adidas, Nike, Starbucks, and major celebrities can inject billions into the market almost overnight.

Why NFT Market Cap Matters

Understanding the NFT market cap is essential for several reasons:

- Investor Sentiment: A rising market cap generally signals bullish investor sentiment and increased demand.

- Ecosystem Maturity: It reflects how developed and diversified the NFT ecosystem is across art, gaming, music, sports, and beyond.

- Valuation Benchmarks: Helps traders and collectors identify underpriced or overpriced collections relative to their market cap.

- Macro Analysis: Provides insight into how NFTs compare to other digital assets in terms of value and potential.

Challenges in Measuring NFT Market Cap

Despite its importance, accurately gauging the NFT market cap comes with hurdles:

- Liquidity Gaps: Many NFTs go untraded for months, making their valuation speculative.

- Price Volatility: Floor prices can swing drastically in short periods.

- Wash Trading: Some platforms report inflated volume or prices due to wash trading—artificially increasing the perceived value of certain collections.

- Non-Standard Assets: NFTs vary by format (art, game items, real estate deeds, etc.), making comparisons tricky.

As a result, NFT market cap should be viewed as a relative indicator, not an absolute truth.

Future Outlook for NFT Market Cap

The future of NFT market cap depends on broader adoption and evolving use cases:

- Gaming and Metaverse: As Web3 games and metaverse platforms mature, in-game NFTs could drive billions in additional market cap.

- Tokenization of Real Assets: Real estate, music rights, and intellectual property being tokenized as NFTs could radically expand the market.

- AI-Generated NFTs: The convergence of AI and NFTs may spawn new categories of high-value digital assets.

- Enterprise Adoption: More corporations are exploring NFTs for loyalty programs, ticketing, and supply chain traceability.

If current trends continue, analysts predict that the NFT market cap could exceed $50 billion by 2026—potentially higher with widespread adoption in Asia and emerging markets.

Final Thoughts

The NFT market cap is more than just a number—it’s a pulse check on the digital ownership revolution. While the market may be volatile, the continued growth in creators, collectors, and enterprise adoption suggests that NFTs are not a passing trend.

By watching NFT market cap closely, investors and builders alike can gain a strategic edge in navigating this dynamic and fast-evolving Web3 space.