The crypto market capitalization is one of the most important metrics used by investors to assess the overall value of the cryptocurrency market. It provides insights into the size, trends, and potential risks within the digital asset space. In this article, we will explore what crypto market capitalization is, how it is calculated, why it matters, and its implications for investors.

1. What is Crypto Market Capitalization?

Crypto market capitalization (crypto market cap) refers to the total value of all cryptocurrencies combined. It serves as a gauge of the industry’s health and growth potential. Just like in traditional finance, market cap is used to compare assets and determine their relative size in the market.

There are two key types of market capitalization in the crypto space:

- Total Market Cap: The cumulative value of all cryptocurrencies.

- Individual Crypto Market Cap: The market cap of a specific cryptocurrency like Bitcoin (BTC) or Ethereum (ETH).

2. How is Crypto Market Capitalization Calculated?

The market capitalization of an individual cryptocurrency is determined using the following formula: Market Cap=Current Price×Circulating Supply\text{Market Cap} = \text{Current Price} \times \text{Circulating Supply}

For example, if Bitcoin is trading at $50,000 per BTC and there are 19 million BTC in circulation, the market cap of Bitcoin would be: 50,000×19,000,000=950 billion USD50,000 \times 19,000,000 = 950 \text{ billion USD}

For the total crypto market capitalization, we sum up the market caps of all individual cryptocurrencies.

3. Why is Crypto Market Capitalization Important?

A. Evaluating Market Trends

The total crypto market cap provides an overall picture of the industry’s growth or decline. A rising market cap suggests increased adoption and investor confidence, while a shrinking market cap may indicate market downturns or bearish sentiment.

B. Comparing Cryptocurrencies

Market cap helps investors classify cryptocurrencies into three main categories:

- Large-cap cryptocurrencies (>$10 billion): Established projects like Bitcoin (BTC) and Ethereum (ETH).

- Mid-cap cryptocurrencies ($1 billion – $10 billion): Promising projects with growth potential, such as Solana (SOL) and Chainlink (LINK).

- Small-cap cryptocurrencies (<$1 billion): High-risk, high-reward investments with lower liquidity.

C. Assessing Investment Risks

Higher market cap assets tend to be more stable and less volatile, whereas lower market cap assets may experience larger price swings. Investors use market cap as a tool to balance risk in their portfolios.

4. Factors Influencing Crypto Market Capitalization

A. Bitcoin’s Dominance

Bitcoin’s market cap accounts for a significant portion of the total crypto market. A rise or fall in Bitcoin often impacts the entire market’s valuation.

B. Investor Sentiment

Market cap fluctuations are influenced by market cycles, hype, and external factors like regulations, institutional adoption, and global economic conditions.

C. Supply and Demand

Cryptocurrencies with limited supply, like Bitcoin (21 million cap), tend to experience higher valuations over time, while inflationary tokens may struggle with long-term market cap growth.

D. Regulatory Developments

Government policies, legal frameworks, and taxation laws can significantly impact crypto valuations and market capitalization.

5. Limitations of Market Capitalization in Crypto

While market cap is a useful metric, it has limitations:

📌 Inflationary Supply Issues: Some projects have high market caps due to large token supplies rather than true value.

📌 Liquidity & Trading Volume: Market cap does not reflect actual liquidity, which determines how easily an asset can be bought or sold.

📌 Potential Market Manipulation: Low-cap cryptocurrencies are susceptible to price manipulation through “pump-and-dump” schemes.

6. Future Outlook of Crypto Market Capitalization

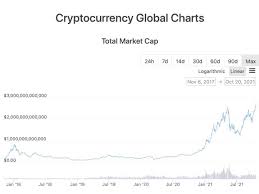

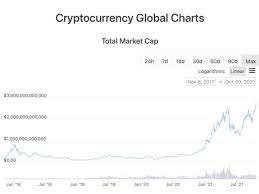

The total crypto market cap has fluctuated dramatically, reaching an all-time high of over $3 trillion in 2021 before falling due to macroeconomic conditions. The future of crypto market capitalization depends on:

- Regulatory clarity and institutional adoption

- The rise of decentralized finance (DeFi) and NFTs

- Bitcoin halving events and supply constraints

- Technological advancements in blockchain networks

Experts predict that as global adoption grows, crypto market capitalization could surpass new all-time highs in the coming years.

7. Conclusion: How Investors Can Use Crypto Market Capitalization

Crypto market capitalization is a crucial metric that helps investors analyze market trends, compare assets, and assess risks. However, it should not be used alone—investors must also consider liquidity, trading volume, and fundamental analysis before making investment decisions.