Bitcoin (BTC) has long been the frontrunner in the cryptocurrency market, capturing global attention and market share since its inception in 2009. One of the most frequently referenced metrics when assessing Bitcoin’s position in the financial landscape is its market capitalization or market cap. Understanding Bitcoin’s market cap is essential for investors, analysts, and anyone involved in the cryptocurrency space. In this article, we will dive deep into what Bitcoin’s market cap is, how it is calculated, and why it is a key indicator of its value and potential growth.

What is Bitcoin Market Cap?

Bitcoin market cap is essentially the total value of all Bitcoin in circulation, calculated by multiplying the current price of one Bitcoin by the total number of Bitcoins in circulation. This metric gives a comprehensive picture of Bitcoin’s market size and helps investors gauge the relative value of Bitcoin compared to other cryptocurrencies and traditional assets.

Formula for Bitcoin Market Cap:

Bitcoin Market Cap=Current Price of Bitcoin×Total Number of Bitcoins in Circulation\text{Bitcoin Market Cap} = \text{Current Price of Bitcoin} \times \text{Total Number of Bitcoins in Circulation}

For example, if Bitcoin is trading at $40,000 and there are 18.5 million Bitcoins in circulation, the market cap would be: 40,000 \times 18,500,000 = 740,000,000,000 \text{ (or $740 billion)}

Why is Bitcoin Market Cap Important?

Bitcoin’s market cap serves as a benchmark for its overall value and offers several insights into the crypto market and Bitcoin’s dominance.

1. Market Sentiment and Trends

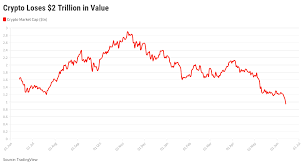

A rising Bitcoin market cap often signifies a bullish sentiment towards Bitcoin, suggesting increasing investor confidence and demand. On the other hand, a falling market cap could indicate market uncertainty or a bearish outlook. Understanding these fluctuations can provide insights into the general market trend and help predict the future direction of Bitcoin prices.

2. Comparisons with Other Cryptocurrencies

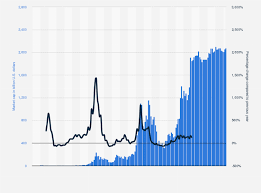

Bitcoin’s market cap is often compared to those of other cryptocurrencies, such as Ethereum (ETH) or newer altcoins. By comparing Bitcoin’s market cap with the market cap of its competitors, investors can assess Bitcoin’s dominance in the crypto space. The dominance metric is calculated by dividing Bitcoin’s market cap by the total market cap of all cryptocurrencies. A higher Bitcoin market cap dominance indicates its strong position relative to other digital assets.

For instance, if Bitcoin has a market cap of $740 billion and the total cryptocurrency market cap is $1.5 trillion, Bitcoin’s market dominance would be: 740,000,000,0001,500,000,000,000=49.33%\frac{740,000,000,000}{1,500,000,000,000} = 49.33\%

This means Bitcoin controls nearly 50% of the total cryptocurrency market, a dominant position that many believe solidifies its role as the market leader.

3. Investor Confidence and Institutional Adoption

A strong and growing Bitcoin market cap signals increased investor interest, especially from institutional investors. Over the past few years, prominent financial institutions such as Tesla, MicroStrategy, and Square have made significant Bitcoin purchases, adding legitimacy to Bitcoin’s status as a store of value and potential hedge against inflation. Institutional investment in Bitcoin also enhances its market cap, making it a more attractive investment for retail investors.

Factors Affecting Bitcoin Market Cap

Several factors influence Bitcoin’s market cap, from market demand to global macroeconomic conditions. Below are some of the most significant factors:

1. Bitcoin Price

The price of Bitcoin is the most direct factor in determining its market cap. Price fluctuations, whether due to speculation, adoption rates, or technological developments, can have a significant impact on market cap. Bitcoin’s volatile nature can lead to rapid changes in its price, and consequently, its market cap. A significant price spike or crash can drastically affect its market cap.

2. Bitcoin Supply

Bitcoin’s total supply is capped at 21 million, a feature embedded in its protocol to prevent inflation. However, as more Bitcoins are mined, the number of Bitcoins in circulation increases. As of now, around 18.5 million Bitcoins have been mined, with the remaining coins expected to be mined over the next few decades. Supply scarcity is a key reason why Bitcoin is often viewed as a store of value.

3. Global Events and Regulations

Global events, including economic crises, government regulations, and policy changes, can significantly affect Bitcoin’s price and market cap. For example, during the COVID-19 pandemic, Bitcoin’s market cap saw tremendous growth as more people sought alternative investments during global economic uncertainty. Similarly, regulatory developments, such as China’s crackdown on cryptocurrency mining and trading, can have a negative effect on Bitcoin’s market cap.

4. Market Adoption and Use Cases

The wider adoption of Bitcoin for real-world applications, such as online payments, remittances, or even as a hedge against inflation, contributes to its growing market cap. As more merchants and financial institutions integrate Bitcoin into their systems, demand for Bitcoin increases, thereby pushing up its market value and market cap.

Bitcoin Market Cap and Its Future

The future of Bitcoin’s market cap is tied to both its continued adoption and its ability to navigate external challenges. As Bitcoin’s price grows and more institutional investors join the market, its market cap will likely continue to rise. However, Bitcoin faces competition from other digital assets and potential regulatory challenges that could dampen its growth.

Institutional and Retail Adoption

The increasing adoption of Bitcoin by both retail investors and institutional players plays a crucial role in its long-term market cap trajectory. If Bitcoin becomes a mainstream financial asset used for payments and as a store of value, its market cap could see exponential growth.

Technological Developments

Innovations in Bitcoin’s ecosystem, such as the development of layer 2 solutions like the Lightning Network, could help solve scalability issues and increase Bitcoin’s adoption, further enhancing its market cap. As more use cases emerge, Bitcoin’s market cap may expand accordingly.

Regulatory Landscape

The regulatory environment surrounding Bitcoin will also play a significant role in its future market cap. Countries with favorable regulations will likely see increased investment in Bitcoin, which could lead to a higher market cap. Conversely, strict regulations or bans in certain regions could hinder growth and reduce Bitcoin’s market cap.

Conclusion

Bitcoin’s market cap is an essential metric in understanding its position in the cryptocurrency market. As the leading digital asset, Bitcoin’s market cap reflects investor confidence, its dominance over other cryptocurrencies, and its role in the broader financial ecosystem. By closely monitoring Bitcoin’s market cap, investors can gain valuable insights into market trends and potential investment opportunities. Whether Bitcoin’s market cap continues to grow or faces challenges in the future, it remains a critical factor for anyone involved in the crypto space.