Introduction

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization, following Bitcoin. Since its launch in 2015, Ethereum’s market cap has experienced significant fluctuations, driven by factors such as adoption, network upgrades, institutional interest, and macroeconomic trends. Understanding Ethereum’s market cap is crucial for investors, developers, and analysts who seek to gauge the network’s value and its potential future growth.

In this article, we will explore what Ethereum’s market capitalization represents, how it has evolved over time, what influences its fluctuations, and its potential trajectory in the years ahead.

What Is Ethereum Market Cap?

Ethereum’s market capitalization (market cap) is the total value of all ETH tokens in circulation. It is calculated using the formula: Market Cap=ETH Price×Total ETH Supply\text{Market Cap} = \text{ETH Price} \times \text{Total ETH Supply}

For example, if Ethereum is trading at $3,500 per ETH and there are 120 million ETH in circulation, its market cap would be: 3,500×120,000,000=420,000,000,0003,500 \times 120,000,000 = 420,000,000,000

or $420 billion.

Market cap provides insight into the relative size of Ethereum compared to other cryptocurrencies and traditional assets, such as stocks and commodities.

Ethereum Market Cap Trends and Growth

Early Years (2015-2017): Initial Growth

Ethereum launched in 2015 at a modest valuation. By mid-2017, its market cap crossed $30 billion, fueled by the rise of Initial Coin Offerings (ICOs) that utilized Ethereum’s smart contracts.

2018: Market Boom and Crash

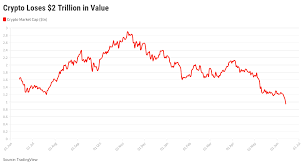

At the peak of the 2017 bull run, Ethereum’s market cap surged past $130 billion, but it plummeted in 2018 due to regulatory concerns, ICO failures, and a broader crypto market crash. By the end of 2018, Ethereum’s valuation had dropped below $15 billion.

2020-2021: DeFi and NFT Boom

The explosion of Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) in 2020-2021 significantly boosted Ethereum’s demand. By November 2021, Ethereum’s market cap reached an all-time high of $570 billion, making it one of the most valuable blockchain networks.

2022: Market Correction

The global economic downturn, rising interest rates, and the collapse of major crypto firms (e.g., Terra, Celsius, FTX) caused Ethereum’s market cap to decline sharply. By the end of 2022, it had fallen below $150 billion.

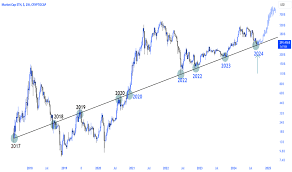

2023-Present: Recovery and Institutional Adoption

Ethereum has shown signs of recovery, with growing institutional adoption, the Ethereum Shanghai upgrade (enabling ETH withdrawals from staking), and increasing interest in Layer 2 solutions such as Arbitrum and Optimism. As of 2024, Ethereum’s market cap is stabilizing in the range of $300-400 billion, depending on market conditions.

Factors Influencing Ethereum Market Cap

1. Ethereum Price Movements

Since market cap = ETH price × circulating supply, Ethereum’s price is the primary driver of market capitalization. Factors affecting price include:

- Network adoption (DeFi, NFTs, enterprise use cases)

- Ethereum upgrades (The Merge, Shanghai upgrade, future scalability solutions)

- Macroeconomic trends (inflation, interest rates, stock market correlation)

2. Supply Dynamics and Staking

Ethereum transitioned to a Proof-of-Stake (PoS) model with The Merge in 2022, reducing ETH issuance. Additionally, Ethereum’s EIP-1559 upgrade burns a portion of transaction fees, making ETH potentially deflationary. A lower ETH supply, combined with increasing demand, can push the market cap higher over time.

3. Institutional Investment

As Ethereum solidifies its position in the blockchain space, more institutional investors and companies are adopting ETH. Exchange-traded funds (ETFs), regulated staking solutions, and integration with traditional finance (TradFi) could further increase its market cap.

4. Competition from Other Blockchains

While Ethereum dominates smart contract platforms, competitors like Solana (SOL), Binance Smart Chain (BSC), and Avalanche (AVAX) offer faster and cheaper transactions. If Ethereum fails to scale effectively, its market cap growth could be limited by these rivals.

5. Global Regulatory Environment

Government regulations significantly impact Ethereum’s market cap. Positive regulatory frameworks (e.g., spot ETH ETFs, pro-crypto laws) can drive growth, whereas strict regulations or bans can suppress market capitalization.

Future Potential of Ethereum Market Cap

Ethereum’s market cap has the potential to surpass $1 trillion if:

- Institutional adoption accelerates (e.g., pension funds, ETFs, governments using ETH).

- Ethereum successfully scales via Layer 2 solutions and future upgrades.

- DeFi and NFTs see mainstream adoption in global finance and entertainment.

- Ethereum’s deflationary supply model creates scarcity, increasing ETH’s value over time.

Some analysts believe Ethereum could eventually rival tech giants like Apple or Microsoft in valuation if Web3 applications, tokenization of real-world assets, and decentralized applications (dApps) become widely adopted.

Conclusion

Ethereum’s market cap is a critical indicator of its growth and adoption. Despite volatility, Ethereum continues to be a dominant force in blockchain technology, smart contracts, and decentralized finance. As the ecosystem evolves with upgrades, institutional investments, and increasing adoption, Ethereum’s market cap could reach new heights, potentially exceeding $1 trillion in the future.