In an era where financial markets are increasingly shaped by technological innovation, long-term crypto investment has emerged as a strategic pathway for wealth accumulation. While short-term trading dominates headlines, investors who adopt a patient, disciplined approach to crypto assets stand to benefit from compounding growth, institutional adoption, and transformative technological advancements. This article explores the core principles of long-term crypto investment, backed by data, expert insights, and actionable strategies to navigate market volatility.

The Case for Long-Term Crypto Investment

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have demonstrated remarkable resilience over time. Bitcoin, the pioneer of digital assets, has delivered a 196.72% compound annual growth rate (CAGR) over the past decade , outperforming traditional assets like gold and the S&P 500. Ethereum, the second-largest cryptocurrency, has seen its long-term holder ratio surge to 74.7% , reflecting growing confidence in its ecosystem.

Institutional players are also embracing crypto as a long-term store of value. MicroStrategy, a publicly traded company, has accumulated 450,000 BTC (worth ~$41 billion as of 2025) , achieving an 80%+ return on its investment . This trend extends to sovereign wealth funds and central banks, with 92 companies and governments holding over 2.66 million BTC (12.7% of total supply) .

Core Strategies for Long-Term Success

1. Focus on Quality Assets

- Bitcoin (BTC): Often referred to as “digital gold,” Bitcoin’s scarcity (21 million cap) and institutional adoption make it a hedge against inflation and currency devaluation.

- Ethereum (ETH): As the backbone of decentralized finance (DeFi) and Web3, Ethereum’s network upgrades (e.g., the 2025 Pectra upgrade) enhance scalability and security .

- Other High-Potential Assets: Projects like Cardano (ADA) and Chainlink (LINK) are valued for their technological innovation and real-world use cases .

2. Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount at regular intervals, reducing the impact of market volatility. For example, an investor who consistently bought $1,000 worth of Bitcoin every month since 2015 would have achieved a 3,500% return by 2025, compared to a lump-sum investment during the same period .

3. Diversification and Rebalancing

- Asset Allocation: Allocate 70% to BTC/ETH, 20% to promising altcoins, and 10% to stablecoins for stability .

- Rebalancing: Periodically adjust your portfolio to maintain target allocations. For instance, if BTC’s value exceeds 70% of your portfolio, rebalance by selling BTC and buying other assets.

4. Ignore Short-Term Noise

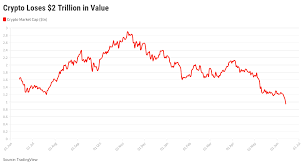

Cryptocurrency markets are notoriously volatile, with Bitcoin’s price swinging by ±20% in a single day. Long-term investors should focus on fundamentals (e.g., adoption rates, regulatory progress) rather than daily price movements. As Michael Saylor, CEO of MicroStrategy, advises: “Investors who focus on the macroeconomic trends and ignore short-term volatility will be rewarded” .

Navigating Risks and Challenges

1. Regulatory Uncertainty

Global regulators are tightening oversight. The U.S. SEC approved Bitcoin spot ETFs in 2024 , while the EU’s Markets in Crypto-Assets (MiCA) framework aims to standardize rules . Investors should prioritize compliance platforms and monitor regulatory updates.

2. Market Volatility

- Use Stop-Loss Orders: Set predefined exit points to limit losses.

- Hedge with Stablecoins: Convert a portion of your portfolio to stablecoins during market downturns.

3. Security Risks

Store assets in cold wallets (e.g., Ledger, Trezor) to protect against hacks. Avoid centralized exchanges with poor security records.

The Future of Long-Term Crypto Investment

By 2025, institutional demand and technological advancements are expected to drive further growth. Galaxy Research predicts Bitcoin could reach $185,000 by Q4 2025 , while Ethereum’s price may surpass $5,500 . Key trends include:

- Real-World Asset Tokenization: Projects like BlackRock’s tokenized bonds are bridging DeFi and traditional finance .

- Cross-Chain Interoperability: Polkadot (DOT) and Solana (SOL) are solving scalability issues, enabling seamless asset transfers .

Conclusion

Long-term crypto investment is not a get-rich-quick scheme but a disciplined approach to wealth creation. By focusing on quality assets, adopting DCA, and staying informed about market trends, investors can harness the transformative potential of blockchain technology. As the crypto market matures, those who remain patient and adaptable will likely emerge as the biggest winners.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research before investing.